Introduction

Berkshire Hathaway is said to be the largest company with many subsidiaries. But, do you know who is the CEO of the company? Well, you’ll get your answers here. This article will guide you through the Berkshire Hathaway company profile and its turnover, the various subsidiaries of Berkshire Hathaway, and lastly SWOT analysis of Berkshire Hathaway company. Let’s check it out.

Berkshire Hathaway is an American multinational conglomerate holding company headquartered in Omaha, Nebraska, United States. The company wholly owns GEICO, Duracell, Dairy Queen, Fruit of the Loom, Helzberg Diamonds, The Pampered Chef, and Russell Brands. It also owns 38.6% of Kraft Foods, 25% of Heinz, the railway company BNSF, and JetBlue Airways. Also, it is the 4th largest public company in the world. It currently has a market capitalization of over $500 billion. If we look by market cap, Berkshire Hathaway is ranked at 7th position making it the fourth-largest public company in the United States, and the largest publicly traded company in the world.

Berkshire Hathaway Company Profile

Berkshire Hathaway is an American insurance company. According to Fortune Global 500, it bagged 11th position. But, wonder who’s the CEO of this company? Well, it’s Warren Buffett, the real player of the investments. In the mid-1960s, Warren Buffet actually brought Hathaway with an intention of firing the existing CEO. Thus, later he became the CEO of Berkshire Hathaway. Using his expertise and knowledge, the company has made many investments in various sectors. On May 1, 2021, Warren Buffett announced that Greg Abel would take the chair of CEO after he retires.

According to the reports, there are more than 70+ subsidiaries of Berkshire Hathaway. As of March 2, 2022, the company has a market cap of 714.22B. There are more than 360,000 people working in the company. Out of the top expensive shares, Berkshire Hathaway comes in the top position. The earnings per share are $26,668 in 2020, a negative change of -46.5% as compared to 2019. Besides that, the total return to the investors in 10 years period is 11.2%. In 2020, Berkshire Hathaway growth rate was 3.28%. This might look brief yet, there’s a lot more to discuss in the Berkshire Hathaway company profile. Let’s check it out.

History Of Berkshire Hathaway

The history of the company states back to the year 1839. Actually, Berkshire Hathaway used to deal in textile mills before actually coming into insurance and other sectors. In 1839, Oliver Chase founded the Valley Falls company that used to deal in textile mills. Later on, in 1929, it merged with Berkshire Cotton Manufacturing Company. Thus, this merged company was called Berkshire Fine Spinning Associates. However, in 1955, this company merged with Hathaway Manufacturing Company. Hathaway Manufacturing company used to deal in whaling (hunting of whales) and China trade. But, in the later stage after World War I, the textile mills suffered losses. At that time, Seabury Stanton was the CEO of the company. Warren buffet basically was watching everything. Thus, he decided to buy Berkshire Hathaway because he saw that the company was not performing well.

Warren Buffett went to Stanton and made an oral offer of $11 1⁄2 per share. This offer was accepted by Seabury Stanton. But, when Buffett received the written offer, he was shocked to see $11 3⁄8 per share. Warren Buffett got angry at this low offer and thus decided to fire Stanton. Thus in 1964, Buffett brought more stake in the company and was successful in firing Stanton. From then onwards, Warren Buffett is the CEO of the company turning 92 in 2022. He has helped the company in buying many companies with his expertise. Eventually, the Berkshire Hathaway company profile is doing well and increased the turnover in recent years.

Subsidiaries Of Berkshire Hathaway

It is surprising to know that Berkshire Hathaway is the largest company in the world to hold many companies. Warren Buffet has helped the company to buy many companies in recent years. Berkshire Hathaway owned 70 + subsidiaries in many fields such as insurance, utilities, energy groups, flight services, clothing sector. Along with that, the list of Berkshire Hathaway companies includes the media, real estate, and financial services. These subsidiaries of Berkshire Hathaway have increased the turnover to $700 billion in today’s time. This has also driven the success of the company in recent years. The following are the subsidiaries of Berkshire Hathaway industry. Let’s check them out.

| Insurance & Finance | Berkshire Hathaway Assurance (100%), BoatUS, Berkadia(50%), Central States Indemnity(100%). GEICO(100%), General Re(100%), Kansas Bankers Surety Company(100%), Medical Protective(100%). National Indemnity Company(100%), United States Liability Insurance Group(100%), Wesco Financial(100%). | |||||

| Clothing & Household Items | Brooks Sports(100%), Fechheimer Brothers Company (100%), Fruit of the Loom(100%), Garanimals(100%). H.H Brown Shoe Group(100%), Justin Brands(100%), Oriental Trading Company(100%). | |||||

| Material & Construction | Benjamin Moore & Co.(100%), Cavalier Homes(100%), Clayton Homes(100%), Forest River(100%), International Metalworking Companies (IMC)(100%). Johns Manville(100%), Kern River Pipeline(91.1%), Lubrizol(100%), MiTek(100%). Northern Natural Gas(91.1%), PacifiCorp(91.1%), Precision Steel Warehouse, Inc(100%). Richline Group(100%), Russell Brands(100%), SE Homes(100%), Shaw Industries, TTI Inc(100%). | |||||

| Media & Logistics | BNSF Railway Company(100%), Business Wire(100%), Charter Brokerage(100%), McLane Company (100%), Omaha World-Herald(100%), WPLG-TV(100%) | |||||

| Food & Beverages | Dairy Queen(99%), Pampered Chef(100%), Pilot Flying J(38.6%), See’s Candies(100%), H. J. Heinz Company(52.5%). | |||||

| Others | AltaLink, Ben Bridge Jeweler(100%), Berkshire Hathaway Automotive(90%), Borsheim’s Fine Jewelry(100%), CTB Inc(100%), Berkshire Hathaway Energy(91.1%). Ebby Halliday Companies(100%), FlightSafety International(100%), Helzberg Diamonds(100%). Larson-Juhl(100%), Louis Motor(100%), Marmon Group(99%), NV Energy(91.1%), Scott Fetzer Company(100%). | |||||

| Business Services | NetJets(100%), Precision Castparts Corp.(100%), XTRA Lease(100%), NetJets Europe(100%). | |||||

| Furniture | Jordan’s Furniture(100%), Nebraska Furniture Mart(80%), CORT Business Services(100%), RC Willey Home Furnishings, Star Furniture(100%). | |||||

Annual Report Of Berkshire Hathway

These are the annual reports of Berkshire Hathaway company. As per the latest Berkshire Hathaway reports as of December 31, 2021, we have shown the Berkshire Hathaway fundamentals. Let’s check it out.

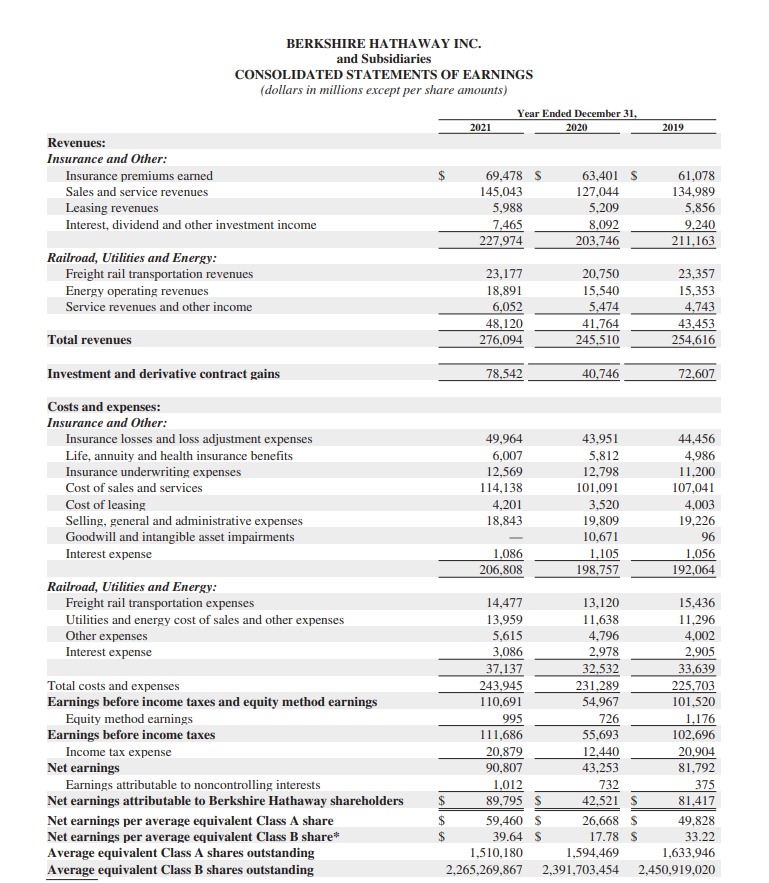

As per the Income statement of the company, the total revenues stand at $276,094 million in 2021 whereas, in 2020, the revenue was $245,510 million. Thus, there was an increase of 12.45% as compared to last year. The net earnings distributed to the shareholders were $89,795 million. Out of it, $59,460 million will get distributed to Class A type of shareholders. Whereas, the remaining $39.64 million is to the Class B type of shareholders. Likewise, if we look into the Cash flow statement of the company, it has performed well as compared to 2020. The net earnings in 2020 were $90,807 million, whereas, in 2020, it was $43,253 million. There was an increase of 109.94% in net earnings as compared to 2020.

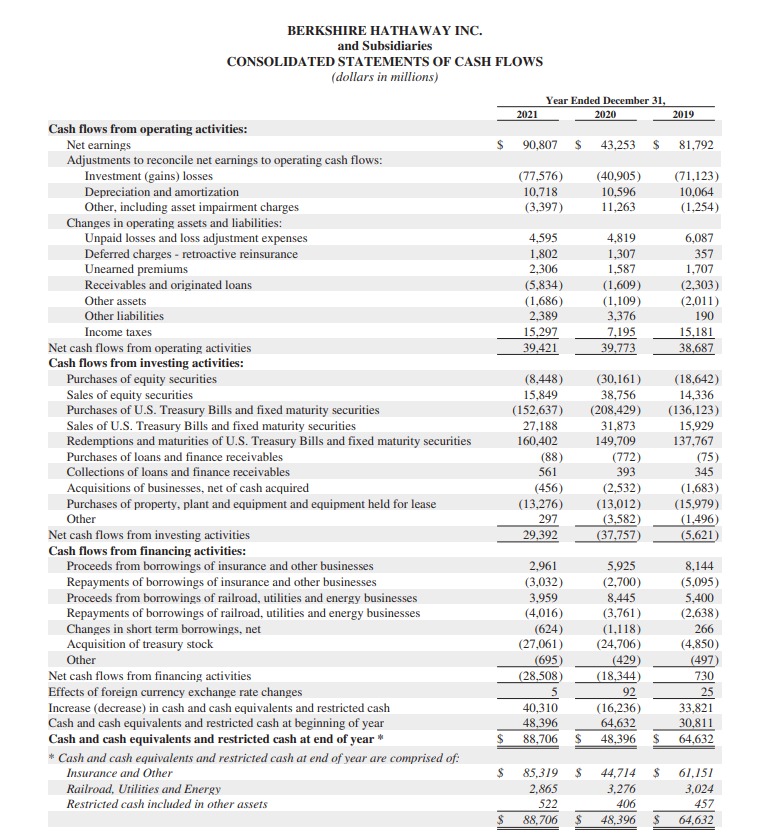

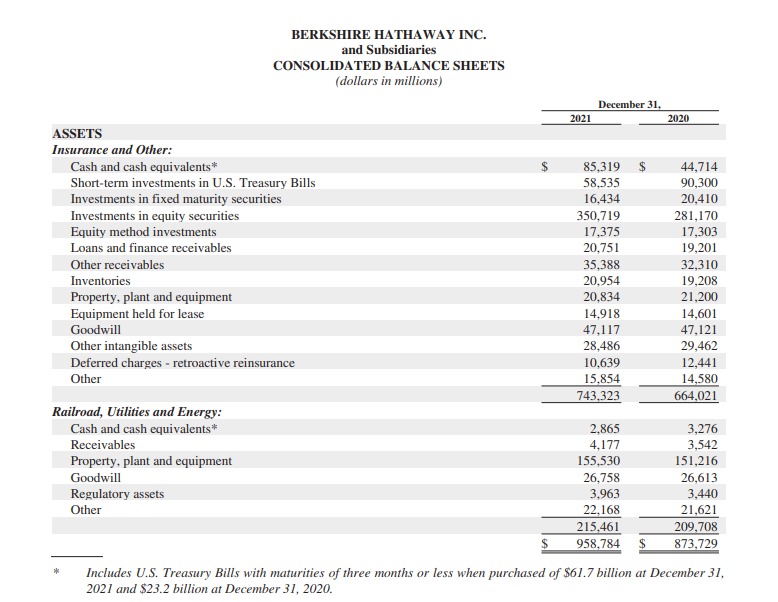

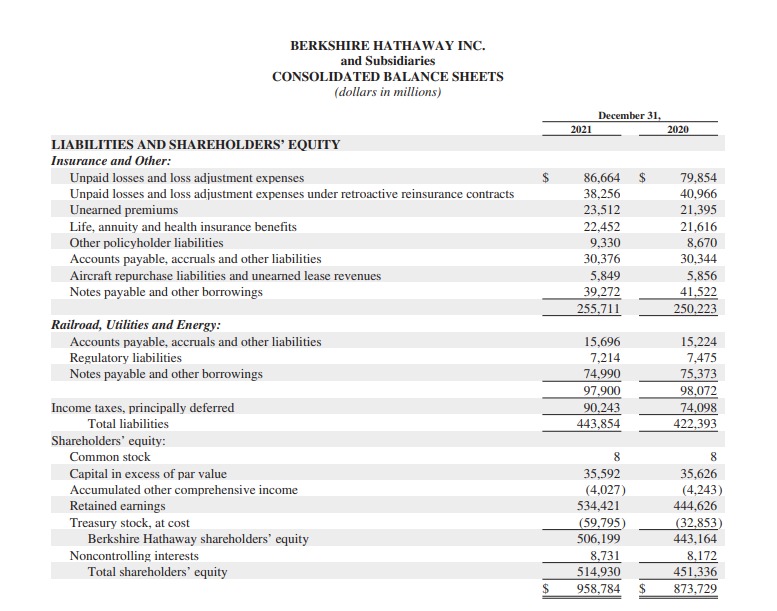

In 2021, the cash flows from operations were $39,421 million and in 2020, it was $39,773 million causing a decrease of 0.88%. Thus, the net cash flow from investments stands at $29,392 million, whereas in 2020, it was a negative figure of (- 37,757) million. However, the net cash flow in 2021 was $88,706 million, whereas, in 2020, it was $48,396 million. However, looking at the balance Sheet of Berkshire Hathaway, there was quite an increase. The Total assets in 2021 were $958,784 million, thus in 2020, it was $873,729 million. Basically, there was an increase of 9.7% as compared to 2020. Likewise, the total liabilities were $443,854 million whereas in 2020 it was $422,393 million. There was a slight increase of 5% as compared to 2020. Subsequently, it has increased the Berkshire Hathaway inventory turnover to 44.7 times.

Stock Prices Of Berkshire Hathaway

Berkshire Hathaway A shares are considered to be the most expensive stocks in the world. Meanwhile, Berkshire Hathaway had announced two types of shares; Class A and Class B shares. Besides that, Berkshire Hathaway no of shares stands at 2.393B. Thus, Berkshire Hathaway got listed in 1980. Berkshire Hathaway stock historical price on March 31, 1982, was $480. Berkshire Hathaway volume on the same date was 100 shares. Later on, the prices saw a tortoise race that was taking place. But, along with that, the prices were also increasing. The Berkshire Hathaway one share price on October 31, 1986, was $2,875. The stocks entered the rally of increasing prices in 1997. On July 31, 1997, Berkshire Hathaway 1 share price was $47,200. However, this was not the end of the rise, there was more to come.

The real rally started on March 30, 2011, when the price shoot the sky at $1,25,300. This was because Warren Buffett was controlling the entire company. Likewise, the Berkshire Hathaway turnover also increased eventually. Berkshire Hathaway Class A share price on February 28, 2018, reached $3,10,250. However, the company saw very less downs in its history. Subsequently, the price of Berkshire Hathaway on May 27, 2021, was $4,35,999. In the past few months, the company is giving positive returns. As per the charts, Berkshire Hathaway lowest share price is of Class B stocks. Berkshire Hathaway B class stock prices on March 3, 2022 stand at $327.74. As per the charts of Berkshire Hathaway per share price returns are 16.11%. Berkshire Hathaway current stock price as of March 3, 2022, is $4,86,109.

SWOT Analysis Of Hathaway

According to Fortune 500, Berkshire Hathway acquired the 6th position whereas the 5th position was acquired by UnitedHealth Group. Although we almost know the Berkshire Hathaway company profile, we need to do the SWOT analysis of the company. Now, that you know about the Berkshire Hathaway company profile and turnover analysis, let’s look into the SWOT analysis of the company.

Strengths

Berkshire Hathaway has many strengths that have made its pillar strong. The following are the strengths of the company:

- Attractive Investments: There are more than 40 companies where Berkshire Hathaway has made investments. With the expertise of Warren Buffett, Berkshire Hathaway invest yearly in new companies and ventures.

- Strong financials: The Total revenue in 2021 was $2,76,094 million. An increase of 12.45% as compared to 2020.

- Many subsidiaries: To date, there are more than 75 subsidiaries of Berkshire Hathaway.

- Diversified Portfolio: Berkshire Hathaway has invested in various sectors and not just one sector or company.

- Increasing stock prices: The stock prices of Berkshire Hathaway are also increasing in the past few years.

Weakness

- Decision rested with Warren Buffett: Warren Buffett being the CEO along with other Board members take the decision. Sometimes he regrets decisions that could have made Berkshire richer.

- Over-Investments: Warren Buffett also regrets certain Investments in some companies like Tesco, Dexter shoe, Waumbec textile, etc. Also, he missed chances where he could have invested in Amazon and Google.

- Over-Dependent on Warren Buffett: Everyone is dependent on Warren Buffett for decisions. The success of the company is dependent on Warren Buffett.

Opportunities

- New Acquisitions: Acquisitions have now become a part of their business model. To date, there are 75+ acquisitions. They are always looking for acquiring new companies.

- Investment in emerging countries: Berkshire Hathaway should look into the Asian countries for investments. Asian countries like India are always open to investment opportunities in their country. This can be an amazing opportunity for Berkshire Hathaway.

- Technology: Berkshire Hathaway should invest in companies that are into technology and make new machines. This will help them gain more success.

Threats

Although the company has many strengths and opportunities in today’s time, there are some threats to the company also. The following are the threats of Berkshire Hathaway company.

- Natural disasters: This world has now become a place of natural calamities. America faces many such incidents in the past few years. For eg, if there is a flood in the state, the plant will get destroyed. Besides that, there will be a loss to the company.

- Change in government: A change in government can also affect the working of the company. If the government changes, they will bring new rules and regulations to the country. These policies will also affect the working of Berkshire Hathaway.

Who Are The Competitors Of Berkshire Hathaway?

The turnover of Berkshire Hathaway has been increasing in the past few years. Even the revenues of the company are increasing year by year. The net worth of Berkshire Hathaway in 2022 is $714.19B. But, as said, every company has some rivals. Even Berkshire Hathaway has some rivals in the industry. Now that you know about the SWOT analysis, let’s look at the competitors of Berkshire Hathaway company profile. Although there are many competitors, we have picked the top 3 rivals of Berkshire Hathaway. The top rival of BRK company is AIG (American International Group). Cornelius Vander Starr founded AIG in 1919. It is an insurance company with operations in more than 80 countries. There are more than 49,600 people working in the company. The total revenue of the AIG company was $43.34 billion whereas that of BRK was $268,677 in 2020.

The second rival of the Berkshire company is AON PLC. It is a British-American insurance company. The total revenue of AON company in 2020 was $10 billion. There are more than 50,000 people working in their company. They have offices in more than 120 countries all around the globe. Lastly, Allianz is the third-largest rival of BRK company. The company was founded on February 5, 1890. It is a German-based multinational company. The total revenue of the company in 2020 was 140.5 billion EUR. There are more than 150,269 people working in the Allianz company. Although there are many competitors, Berkshire Hathaway tops in terms of the insurance.

Conclusion

Berkshire Hathaway company is the largest company in terms of acquiring many companies. According to World’s most desired companies, BRK bagged the 6th position. It is an insurance company, which focuses on the acquisition of large and well-established companies. It has been listed on New York Stock Exchange since 1982. In this article, we have described the SWOT analysis of Berkshire Hathaway company. Also, we have discussed the annual report and turnover of Berkshire Hathaway company. Along with that, this article also discusses various subsidiaries of the company. We hope this article has given enough information about the company. If you have any questions, you can comment down below.

FAQs

Well, it is because the Berkshire Hathaway A shares did not undergo shares spliting. Basically, there are two types of shares of Berkshire Hathaway: A class and B class shares. Mostly many companies try to split or divide their shares in smaller number so that many people can buy them. For eg, assume there are 200 shares of market cap $6000. The company decides to split each 1 share into 2. So now, there are 400 shares, but the share price now will be $150. However, Berkshire Hathaway did not split the A class shares. Even, Class B Berkshire Hathaway shares cannot be split. Therefore, Berkshire Hathaway stock share price is expensive.

No. Berkshire Hathaway stocks dividends are not declared yet. In an interview Warren Buffett was asked the same question, to which he replied, “If the investors want, they can take back dividends. There is no problem in that. However, many people who have Berkshire Hathaway equity holdings think that I (Warren Buffett) can reinvest it in a better way. I believe dividends should get invested in the growth of the company.” Therefore, there is no dividend paid to the shareholders of Berkshire Hathaway.

In the recent SEC filings, there are 44 holdings of Berkshire Hathaway and Apple is in the top Four Giants driving its value. The list of Berkshire Hathaway holdings hold a value of $330,952,724,000. Berkshire Hathaway investment in Paytm of $300 million in 2018 paved a way in Indian economy. Berkshire Hathaway investments portfolio value is almost $340 million.