Introduction

China National Petroleum Corporation’s annual report has not been performing well in recent years. So, is it advised to buy CNPC stocks in such a situation? Well, before that you need to know a lot about the finances of the company. This article will act as a full-proof guide through the annual report of CNPC company, CNPC subsidiaries held to date, major deals that have occurred in recent years, China National Petroleum Corporation stock price, and lastly, should you buy CNPC stocks or not. Let’s check it out.

The annual report of the China National Petroleum Corporation (CNPC) is one of the most important reports for the Chinese state and the international community. The report looks at the entire company and its operations. The company is one of the biggest in the world and ranked as the top oil producer in the world. The annual report is a good way to understand the influence of the company and its impact on the global economy. The report covers a lot of ground and we will try to cover the main aspects of it.

Brief About China National Petroleum Corporation

CNPC is one the largest oil and gas corporation in the whole world. According to the Fortune Global 500, CNPC got the 4th rank, whereas China State Grid and Amazon got the 3rd and 2nd rank globally. China National Petroleum Corporation got established on September 17, 1988. The company offers various products like crude oil, natural gas, refined products, etc to businesses and customers. It got listed on the stock exchange on November 5, 1999. The interesting part is that CNPC did not get itself listed on the exchange. They created another company called “PetroChina” in 1999. Thus, CNPC tried to transfer half of its assets and liabilities to PetroChina. PetroChina and CNPC have now come into a joint venture where they will deal in overseas assets. Here, 50% of the share remains with PetroChina.

CNPC is a parent company of PetroChina and thus, CNPC controls the activities of PetroChina. Currently, PetroChina’s market cap is $155.14B. There are more than 35 subsidiaries of CNPC in the whole world. Therefore, they have succeeded in creating their presence globally. Currently, they are operating 91 energy-related projects. The China National Petroleum Corporation annual report gives a business review of the company.

History Of CNPC

Although CNPC got established in 1988, its history dates back to 1955. The Ministry of Petroleum Industry was supervising the oil and gas power at that time i.e 1955. From 1955-to 1969, there were 4 oil fields in various basins in China. Thus, the Ministry recommended forming CNPC on September 17, 1988. Their main work was to overlook the operations of the oil and gas power in the country. It was a state-owned company formed in China. At the same time, the Chinese government disbanded the Ministry of Petroleum Industry and the entire work got transferred to CNPC.

CNPC started overseas operations in the year 1993. SAPET, one of the CNPC subsidiaries, has signed a service agreement with the Peruvian government to run Block VII in the Talara Province basin. In June 1997, CNPC took a 40% stake in Greater Nile Petroleum Operating Company. In August 2005, they acquired Alberta-based PetroKazakhstan for US$4.18 billion. There are many acquisitions that happened in the gap of a few years. in 2006, PetroChina brought 67% of the shares from the parent company CNPC. CNPC has proved reserves of 3.7 billion barrels of oil equal to 590,000,000 m3.

China National Petroleum Corporation Annual Report

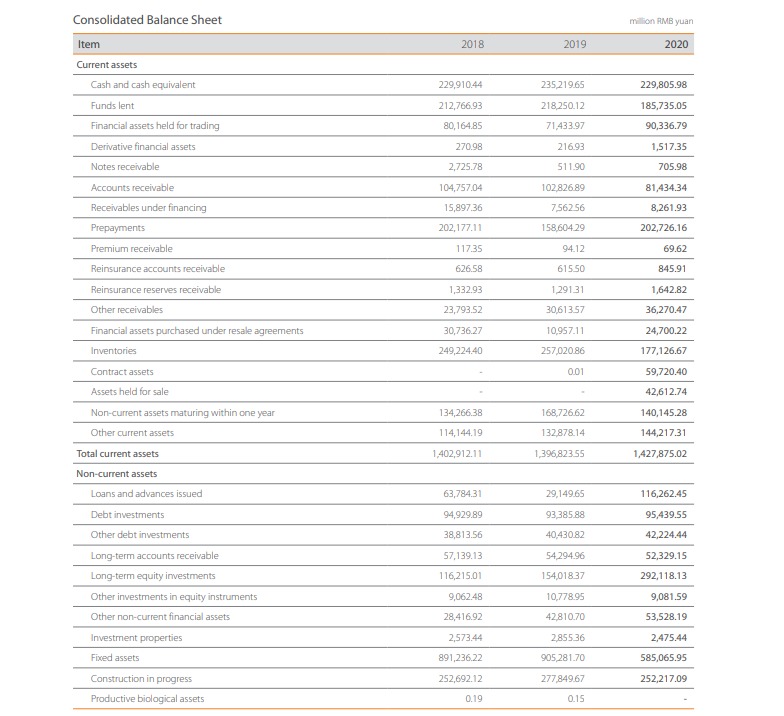

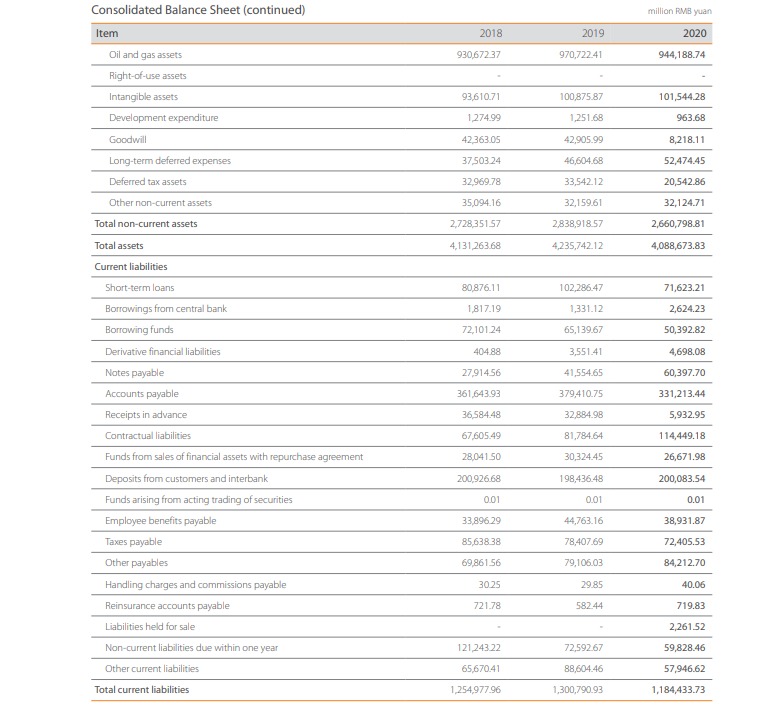

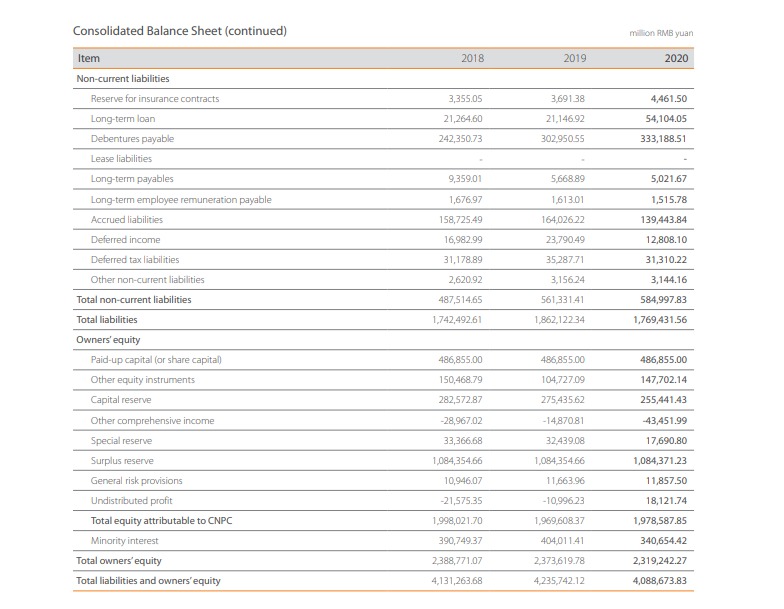

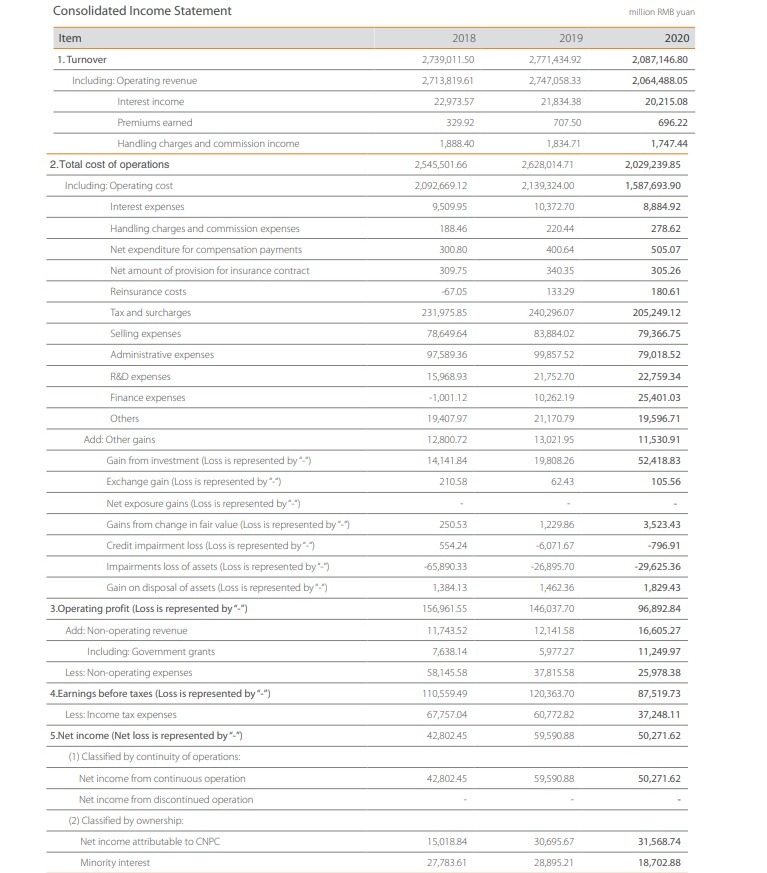

Here, are the financial statements of the CNPC company. We have taken from the annual report of the company for the year 2020. The financial statements include the Balance sheet and also the Income statement. Thus, the figures calculated are for the year 2020. Let’s have a look.

As per the China National Petroleum Corporation annual report, the total non-current assets in the year 2020 were $420672.29 million. The total assets came out to be $646419.33 million whereas Sinopec had $317,515 million worth of assets. The current liabilities of the firm were $187258.97 million. In comparison, non-current liabilities in 2020 were $92488.16 million. In total, liabilities came out to be $2,79,747.13 million and that of Sinopec was $15,232,246 million. When talking about equity unsettled to CNPC, it was $312814.74 million. Whereas in the year 2019, it was $311395.08 million. Besides that, the total equity of the owners came out to be $366672.20 million whereas, in 2019, it was $375269.29 million.

The Income Statement of CNPC did a poor performance on the annual report. In 2020, the total revenue or turnover of the company was $329977.91 billion. While Sinopec’s turnover was $318.09 billion. Both the companies saw a decrease as compared to 2019. The operating profit was $15318.76 million and that of Sinopec was $32.9 billion. The EBT of the company in 2020 was $13836.87 million. Finally, the net income of CNPC comes out to be $7947.94 million.

Analysis Of The Annual Reports

Well, now that you know about the financial figures of the company. Let’s look at the analysis of the annual report. The total asset turnover in recent years has seen a decrease to 0.51 in 2020 from 0.65 in 2019. If we talk about assets, there was a 3.47% decrease as compared to 2019. Similarly, in the liabilities, there was a decrease of 4.978% in both years (2019 & 2020). The capital reserve was $40385.29 million in 2020, whereas in 2019 it was $43546.37 million. There was a decrease of 7.2% between both years.

Similarly, even the revenue saw a decrease of 24.6% when compared to 2019 revenue. After looking at all the figures, there are two factors that have influenced the figures to fall. The first reason is the Covid 19 crisis, which had shaken the world economy. The other factor is that the figures are dropping year by year from 2018. Because many incidents happened like oil spills in the sea, the 2006 gas leak in Chongqing, etc. But, we need to be positive for the annual report of 2021, releasing soon.

China National Petroleum Corporation Stock Price

Now that you got a view of the analysis of the financial statements, let’s look at the stock prices of the company. CNPC advised PetroChina to get listed in the stock exchange. The company listed in November 1999. The PetroChina market cap as of February 18, 2022, is 156.88B. At that time, in April 2000, China National Petroleum Corporation stock price was $15.13. The Stock price of CNPC on May 29, 2003, was $25.32. After that, the plane of China National Petroleum Corporation stock price just took off. Thus, on October 30, 2007, the stock price of CNPC was $262.60. This was an all-time high.

Eventually, the China National Petroleum Corporation stock price saw various ups and downs after that. In the past 5 years, there was a decrease of 24.94% in the stock prices. In the past year, there was the highest mark recorded was $55.18 and the lowest was $34.15. Currently, the China National Petroleum Corporation stock price as of February 18, 2022, is $52.39.

Major Deals In The Recent Years

There are many CNPC subsidiaries present across the globe. They had a major impact and have also contributed to the business model of the company. CNPC has been one of the major investors in Sudan. The Great wall drilling company invested $700 million in drilling 57 wells in Sudan over a 3-year period since 1997. In 2004, they built a pipeline from the Middle East to the Xinjiang area. Eventually, in 2005, CNPC bought PetroKazakhstan, an oil-based company, for $4.18 billion. In 2006, CNPC ran an international union to explore & develop oil and gas fields in the Aral Sea. To enter Iraq, CNPC started building an oil field named Ahdab in March 2009. The Sudanese Petroleum Ministry, in 2010, awarded a contract to CNPC to build 5 oil rigs for $75.5 million.

In December 2011, Afghanistan signed a deal with CNPC for building oil blocks in the Amyu Daryaa basin. Similarly, there were many deals signed with many companies and countries. In May 2014, CNPC and Russia came into a 30-year deal for making worth $400 billion. CNPC and SINOPEC signed a deal on December 1, 2021, where they agreed to share their technology and their equipment for each other benefit. This resulted in the increase of PetroChina’s stock price from $42.89 to $44.78.

CNPC Subsidiaries

There are many CNPC subsidiaries present across the globe. They had a major impact and have also contributed to the business model of the company. On November 5, 1999, CNPC created PetroChina company. PetroChina is the one listed on the stock exchange. Once they created the company, CNPC also shifted 50% of the balance sheet items to the company. Chuanqing Drilling Engineering Co. Ltd is another subsidiary of CNPC. It got founded in 1970. Founded in 1937, Baoji Oilfield Machinery (BOMCO) is also a part of CNPC. It develops oilfield machinery and tools related to it. BOMCO, with 6,600 million assets, covers an area of over 2,000,000 sq m and has 6,000 staff employees, of whom over 2000 are technical specialists and engineers.

Kunlun Energy is one of the CNPC subsidiaries. In 2012, Kunlun Energy clubbed its operations with that of PetroChina. Kunlun Energy in 2015, acquired 100% equity interest in PetroChina Kunlun Gas. In September 2017, the company acquired a 51% stake in PetroChina Jingtang LNG Co., Ltd. held by PetroChina. China National Logging Corporation (CNLC) is one of the CNPC subsidiaries. CNLC got founded in 1995 and thus, engages in mud logging, wireline logging, and well testing work. Similarly, there are many other subsidiaries that have boosted the China National Petroleum Corporation share price i.e (current price = $52.95) to new heights.

Who Are The Competitors Of CNPC?

Just like every person has some rivals, even companies face the same thing. Although there are many rivals, we have short-listed some top rivals of the company. Not to forget, Sinopec is the top rival of CNPC. On February 25, 2000, Sinopec got established. Basically, China Petroleum & Chemical Corporation is the parent company of Sinopec. In total, the revenue of the company is $283 Billion whereas there are 553,833 people working in the company. The share price of Sinopec (SNP) is 4.38 Yuan. In spite of the rival, CNPC, and Sinopec came into a deal in December 2021. This deal basically aimed at providing each other’s technology, thus improving their company’s work. Another biggest rival of CNPC is CNOOC.

CNOOC is a producer of crude oil and natural gas having plants all across the world. The company got founded in August 1999. As per the financial reports, the revenue was $108 Billion. Likewise, there are 18,103 people working in their company. Petrobras is another top rival of CNPC. The company has its base in Rio De Janerio and got founded on October 3, 1953. PetroBras is a state-owned company that deals in oil production and gas. According to Fortune Global 500, the company bagged 120th rank. Basically, looking at the annual reports, the company has a revenue of $76.6 billion. Besides that, there were 57,983 people working in the company.

Should You Buy CNPC (PetroChina) Stocks?

Now that you have gone through the annual report of the company, let’s discuss whether you should buy PetroChina’s or CNPC stock or not. Well, the financial figures of the CNPC company have already told how the company is performing in the past few years. Again, if you wish to invest in CNPC you need to buy PetroChina stocks. Because the company allocated PetroChina as its Ticker. For the past year, the company is giving a return of 18.19% but that’s not the case with 3 years’ data. As per 3 years of stock data, there has been a drop of 15.15%.

But, again we look at the latest deals CNPC is dealing with, Sinopec stands at the top. This deal happened in December 2021, and it will prove to give better returns in the future. The main game-changer will be the annual report which will get published in March. If the company, gives positive results, it will lead to rising in the prices of the stock and vice versa for negative results. Therefore, if you want to buy the stock, you can buy it now and hold it for the long term. Again, just do research before investing.

Conclusion

We hope you enjoyed our article about China National Petroleum Corporation. With this knowledge, we know that you can make the most of your financial decisions and investments when you do your analysis with the help of a company like CNPC. This article discusses the annual report of CNPC and the analysis of the company. Also, it explains the history of China National Petroleum Corporation stock price. In recent years, there have been many deals that have boosted the performance of the company. Thus, if you wish to invest in CNPC, it can turn out to be a good option. But, the final decision stays with you, after all, it is your money that you’ll be putting.