Introduction

UnitedHealth Group has created a huge net worth in recent years. But, Is this stock worth your investment? Will UNH give maximum returns in the future? Well, you’re on the right path. This article will guide you through a brief history of UNH company, Different UnitedHealth subsidiaries, an analysis of United health group stocks prices, and lastly, whether you should buy UNH stocks or not.

The UnitedHealth Group is one of the biggest health care companies in America, if not the whole world. The UnitedHealth Group is primarily a health insurance provider and so it’s no surprise to know that the company has a history of $1 billion. In the year 2015, the company’s revenues topped with the mark of $150 billion, which resulted in the company taking the 19th position in the list of the top health service companies in the world. For our UnitedHealth Group review we’re going to take a look at its profits, revenue, and net earnings. We’ll also take a look at how UnitedHealth Group became such a huge company and how it serves its customers. Thus, this article will reveal various facts about Unitedhealth care group and its subsidiaries. Let’s check it out.

Brief About United Healthcare Group

The United Health Group is the largest healthcare and insurance company in America. They strive hard to create a modern health care system in the country. The United health group works with the government, providers so that they can provide health care services to more than 146 million people. Richard Taylor Burke is the founder of UnitedHealth group. UnitedHealth group ranking in Fortune 500 Global, UNG bagged 8th rank, whereas CVS health acquired the 7th rank. Likewise, Unitedhealth group Fortune 500 rank was 5th rank. The company made a revenue of $287.597B as of December 31, 2021. According to the annual report, the company has more than 330,000 people working in their company. In December 2021, UnitedHealth group turnover was 0.35 times. As of March 5, 2022, the UnitedHealth group market cap is $469.10 billion.

History Of UHG

Although the United health group business started back in 1977, the history states back in 1974. In 1974, Richard Taylor Burke founded Charter Med Incorporated, a company based in Minnesota. But, The company was not doing well, people were unaware of this firm. Therefore, in 1977, United healthcare got founded. The main purpose of this company was to reorganize Charter Med. Eventually, it became the parent company of Charter Med. In 1988, the company started PBM services. But, soon sold this subsidiary to SmithKline Beecham in 1994 for $2.3 billion. In 1994, it acquired a Florida-based insurer company called Ramsey-HMO.

Likewise, the company acquired many companies like MetraHealth Companies Inc, HealthPartners, GeoAccess, Mid Atlantic Medical Services, Golden Rule Financial, and Touchpoint Health Plan. In 2004, the United health group took over Oxford Health Plans and PacifiCare Health Systems 2005. yet, there were many acquisitions that took place in its history. In February 2008, Ingenix, a subsidiary of United health was accused that it was recording low medical charges in their database. Thus, in 2009, Ingenx settled the case where they will again maintain healthy records of the medical charges. On October 15, 2006, William W. McGuire stepped down as CEO of United Health group because he saw some fraud happening in the employee stocks. Thus, there were many incidents that affected the Unitedhealth group net worth in these years.

UnitedHealth Group Subsidiaries

United health care providers work towards the overall being of the people on this globe. The market cap of the company stands at $434,354 million. Basically, Unitedhealth group held many subsidiaries in the past few years. But, in today’s date, there are two major subsidiaries of United health i.e United Healthcare and Optum. Likewise, even Optum has many companies under its name. The following are the Unitedhealth subsidiaries given below. Let’s check it out.

United Healthcare

United Healthcare is one of the major subsidiaries of the United group. It is further divided into 4 major divisions; UnitedHealthcare Employer and Individual, UnitedHealthcare Medicare and Retirement, UnitedHealthcare Community and State, and UnitedHealthcare Global. UHC Medicare and retirement tries to provide services to people above the age of 50. They aim at providing services to more than 50 states of the United States. As of December 31, 2020, UnitedHealthcare had more than 9.2 million people in the Medicare Part D programs. Also, it includes 4.0 million individuals in stand-alone Medicare Part D plans. Whereas as per the December 31, 2020, annual report, more than 36% of the money comes from this sector. UHC Community and the state try to provide services to those who can’t afford these services.

Basically, these are the people belonging to very low-income groups or blind, disabled, deaf people. As per the annual report, they served 6.6 million people all across 31 states in the US. UHC Employer and Individual targets employers across the nation. They basically try to provide health benefit plans to the people working in the companies. As of December 31, 2020, they have served 26.2 million people across 50 states. Whereas the UHC global tries to provide its services across many countries in this world. As of December 31, 2020, they have served 7.6 million people with dental and medical benefits. And, in total, they work in 150 countries as of now. The UnitedHealth group subsidiaries have increased their net worth in recent years.

Optum

Optum is the other major subsidiary of the United healthcare group. It was founded in 2011, under the brand UNH. Optum is an information and technology-based services company. Again, Optum has many brands working under them. They include OptumRx, OptumHealth, and OptumInsight. OptumRx tries to provide pharmacy care services across more than 67,000 retail pharmacies. Also, they also supply drugs that are limited in stock along with other services. In 2020, they spent $105 billion on their services. OptumHealth caters to various healthcare needs of the people. They help people to address various complex chronic diseases and urgent health care services. These services are given in exchange for some fees. You have to be a subscriber of their plan to avail these plans.

OptumInsight layoffs various data, analytics, research, consulting, technology, and managed services solutions. They try to club the expertise of the R&D and improve the ongoing technology of the healthcare sector. This has helped them achieve various milestones. As of December 31, 2020, they generated revenue of y $20.2 billion. Along with that, they have also signed contracts worth $7.5 billion. Optum said on January 15, 2019, that the company’s sales has topped $100 billion for the first time, increasing by 11.1 percent year over year to $101.3 billion. The success of these subsidiaries has boosted the United health group stock prices.

How Much Is UnitedHealth Group Net Worth?

You might be thinking, how much could be the Unitedhealth group net worth? Well, keep on reading further. The UnitedHealth group net worth as of February 25, 2022, is $428.95B. Andrew Witty is the CEO of the UnitedHealth group. The net worth of the CEO is $34.7M. The company invests about $2.9 billion annually in technology and innovation. It processes more than 600 billion digital transactions annually. Looking at the future outlook, UNH is trying to improve its services and reach many customers. The company’s revenue stands at $287.597B in the year 2020. Thus, the UnitedHealth group’s net worth is increasing day by day.

United Health Group Stocks

As per the UnitedHealth group stock price history, the company was listed in October 1984. To date, the graph of the company has taken off the plane. The United health group stocks on October 31, 1984, were $0.1444. In the initial years of business, the company saw a steady and slow slope. The prices were quite stable and constant. There was a step increase in the Unitedhealth prices. The price of the UNH stock on May 31, 1991, was $1.531. From the period 1994 to 2000, the United health group stocks saw a step-by-step increase in prices. In fact, they were doing pretty well. Thus, the price on September 28, 2000, was $12.34. From this point, the prices shot up. This was the take-off point for the company. On December 30, 2005, the price reached $62.14. Likewise, the Unitedhealth group share price on November 28, 2008, dropped to $21.01.

However, this drop proved to be a boon for the company. The prices were accelerating to a greater extent. On July 30, 2015, the price of Unitedhealth group was $121.40. Thus, the price on January 31, 2018, was $236.78. There was a trade of 5.19 million in the secondary market. After that, the United health group stocks prices saw various ups and downs, but this couldn’t change the graph of the company. On May 27, 2021, the UnitedHealth Inc stock price reached an all-time high of $411.92 in a few years. If we come to the present time, the current price of UNH stock on February 25, 2022, was $475.75. Therefore, this has accelerated the Unitedhealth group net worth to $447.63B.

Annual Report Of United Health Group

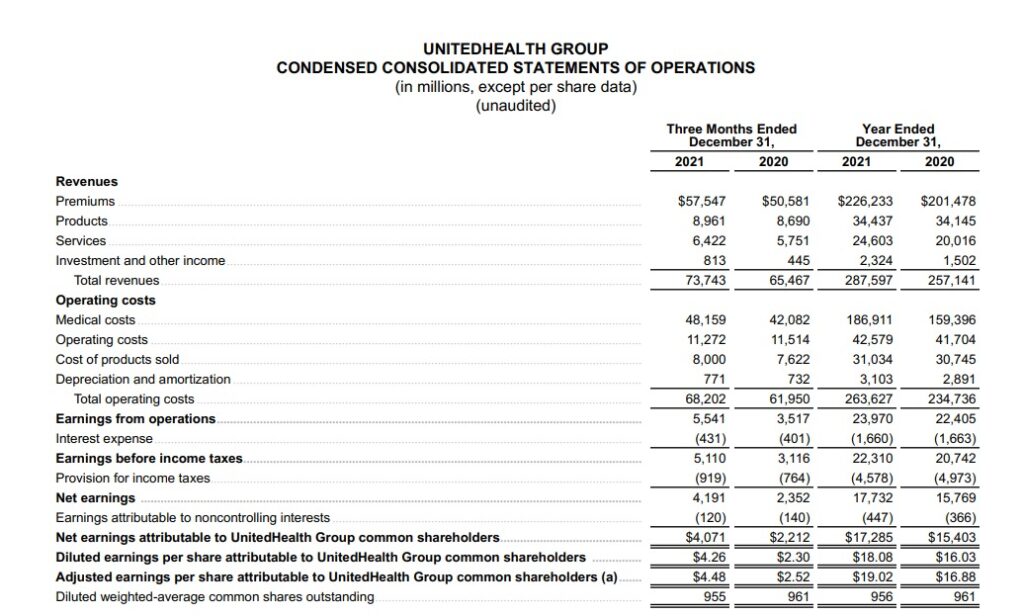

These are UnitedHealth group financials as of December 31, 2020. Eventually, these statements include the Income statements, cash flow statements, and balance sheet of the company.

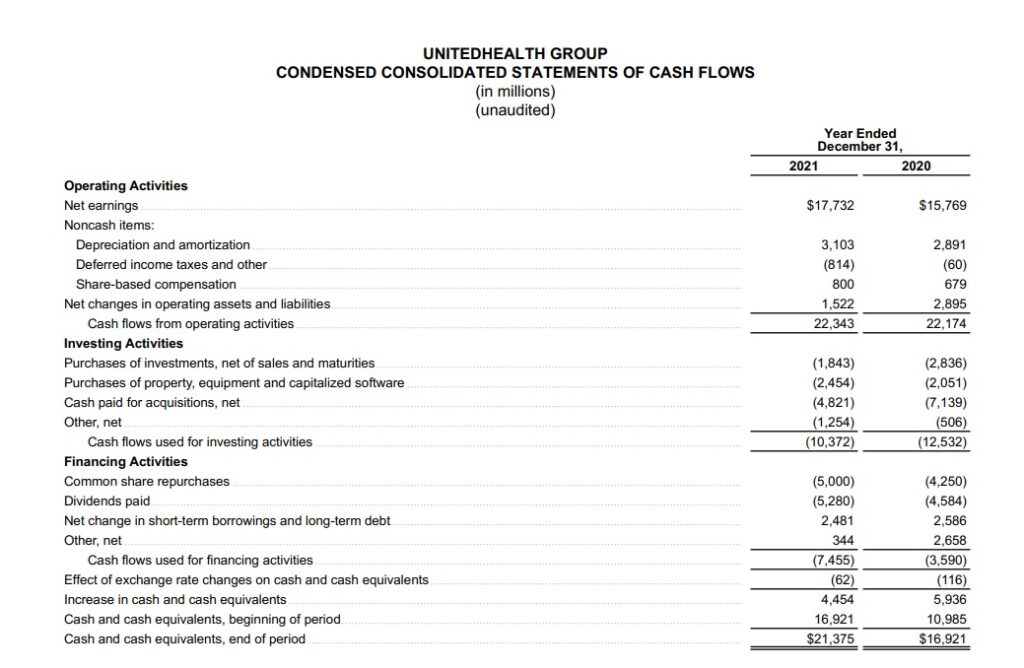

As per the annual report for the year ending December 31, 2021, the company did well as compared to last year. The revenues for the year 2021 were $287,597 million whereas in 2020 it was $257,141 million. Whereas the income received from the investment in 2021 was $2,324 million while in 2020, it was $1,502 million. There was an increase of 54.7% as compared to last year. Basically, most of the income has derived from UnitedHealth care. The net earnings of the company were $17,285 million for the year 2021. Likewise, if we look into the cash flow statement, there were stable cash flows. The cash from operations came out to be $22,343 million. A slight increase of 0.76% as compared to 2020. Likewise, there was less purchase of investments in 2021, whereas, in 2020, the company purchased $2,836 million worth of investments.

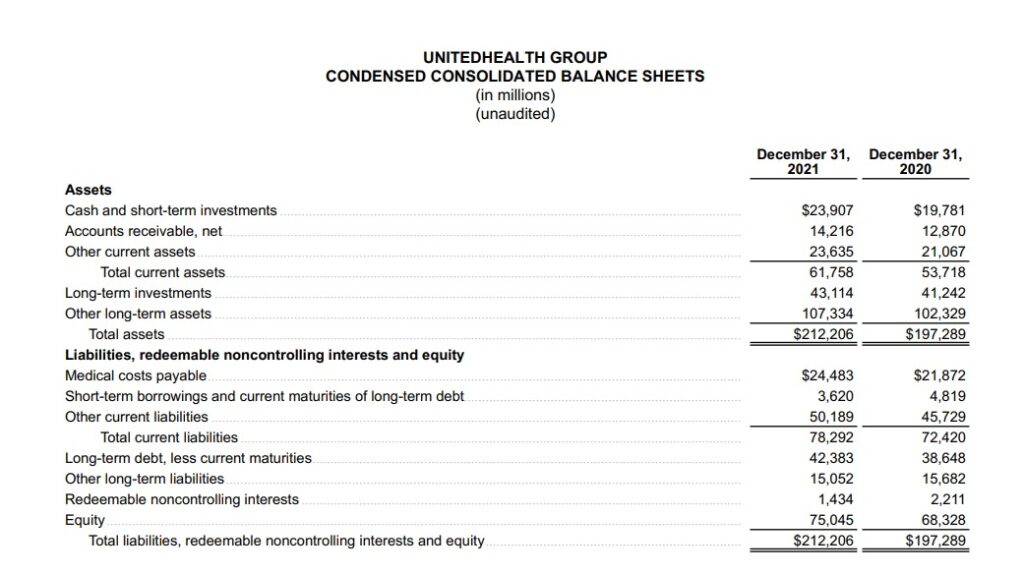

However, the cash from investments was $10,372 million. Therefore, the total net cash flow stands at $21,375 million. Analyzing the balance sheet of the company, there was an increase in the items. The total assets of Unitedhealth group were $212,206 million. They have comparatively increased from 2020. The cash with the company also increased from $19,781 to $23,907 million. The debt of the company raised to $42,383 million. Thus, the total liabilities of the company in 2021 were $212,206 million. An increase of 7.5% as compared to last year. Therefore, the UnitedHealth group net worth has also increased. Besides that, UnitedHealth Q1 earnings in 2022 were $4.48 per share.

Dividend History Of UNH

That the question arises, how much does UnitedHealth Group pay dividends to its shareholders? Well, keep reading further. The UnitedHealth group started giving dividends in the year 1990. The UNH dividend in 1990 was $0.03. From 1990 to 2010, the company was paying the same rate of dividend (i.e $0.03). From May 2010 to February 2011, the company paid $0.125 as a dividend. Thus, from May 2011 to February 2012, the dividend rate was $0.165. As the company was progressing, they even increased the dividend rate.

Eventually, the rate of dividend in July 2012 was $0.2125. This rate was constant till June 2013. In 2013 and 2014, the rate was $0.28. Again, the dividend rate was increased from $0.28 to $0.375. From September 2015 to February 2016, the dividend of UNH was $0.50. After that, the dividend of the company increased from $0.625 to $1.45. Thus, the current dividend rate announced in February 2022 for March 2022 was $1.75.

Analysis Of The Company

As per the financials, Unitedhealth is doing pretty well. In recent years, the investments of the company have also increased. The company has also purchased properties and assets in the previous year (i.e 2022). If we look at the charts of the UNH stock prices, the company is doing quite well. In recent years, the UnitedHealth group has also acquired many companies and generated huge revenue. The UnitedHealth subsidiaries are also performing well in the past few years. In 2020, the company did acquisitions of $321 million. Overall, to sum up, the company is going well and it is predicted that the company’s performance in 2022 will also be good.

Should You Invest In United Healthcare Group?

You might be thinking, should I buy Unitedhealth stocks? Well, the answer is Yes. If you want to buy this stock, this is the right time. Unitedhealth company is going pretty well as per the December 2021 annual report. As well as, the UNH stocks have also performed well in recent years. In today date, the stocks are given 19.86% returns. And on yearly basis, the company is giving 143.53% returns on investment. There has been a constant increase for 5 years return also. Thus, if you wish to keep it as a long-term investment, it will surely give better returns in the future. Or else, if you want to opt for intraday trading for this stock, it would also be a good choice. Just watch the market, do a little bit of research before investing.

Conclusion

The UnitedHealth Group has a focus on the health sector and has various subsidiaries that are related to this type of market. These subsidiaries are in the business of providing insurance to individuals. The group has been able to expand rapidly over the past few years and has a global presence. It has also increased the Unitedhealth group net worth in recent years. There are other businesses that form part of this group, which include companies like UnitedHealthcare, as well as others. This article discusses the various Unitedhealth group subsidiaries. Also, the UnitedHealth stocks are discussed above. As of now, the company has a value of close to $200 billion, which makes it one of the largest health insurance companies in the United States. We hope, this article was useful to you. If you have questions related to UNH, comment down below.

FAQs

No. UnitedHealth group is a profit company that wants to improve and create a better health system in the countries. Whereas, UnitedHealth Foundation and UnitedHealthcare Children’s Foundation are non-profit organizations. They were started by UNH group in 1999. The United Health Foundation has invested more than $170 million to improve health and health care system in the country.