Introduction

A positive change in the working capital can increase the cash flow of the company. Many companies are facing a low or a negative working value. But, how to eliminate a negative figure? Well, you’re on the right path. This article will guide you through how to calculate the change in working capital with an example, formula to calculate working capital, reasons why working capital is important for the company, and lastly, ways through which you can improve your working capital.

Calculating working capital is important for businesses that need to know how much working capital they are short or over. Working capital is the value of a business’s assets that is available to support its operations and pay its debts. Without working capital, a business cannot function. Working capital is a cash flow problem that needs to be solved for a business to survive. Because of this, it is important for all business owners to know how to do this calculation of working capital with an example. Let’s check it out.

What Does Working Capital Mean?

Working capital from the name itself says that the capital that could get used for the working of the company in a period of one year. In simple words, it tells how much money the company has for day to day operations of the business. It is a difference between the current operating assets and current operating liabilities. Thus, it can be used to predict the financial health of the company for a short-term period. Also, you can use WC to measure the company’s liquidity.

As per the liquidity ratios, the current ratio is also known as the Working capital ratio. But, what’s the difference between both? Well, when you calculate the current ratio, you are actually dividing current assets by current liabilities. Whereas in working capital you’re actually deducting the liabilities from current assets. Besides that, in the first case, you’ll get the answer in the form of a ratio. On the other hand, the answer will be in the form of amount. For eg, current assets and liabilities are $50,000 and $30,000. the current ratio comes out to be 1.67 and the working capital comes to be $20,000. Both are different yet connected to each other.

What's Net Working Capital?

Working capital is also called Net working capital. Net working capital might look the same as gross working capital. But, both have some differences. The formula to calculate net working capital is gross working capital (GWC ) minus the current liabilities. As you all know, the word gross means the total of all items and net means some items get deducted from the list. But, what’s that one thing that we need to deduct from the gross working capital? Well, that’s current liabilities (CL). In short, GWC is the sum of total current assets available to the company. And when you deduct CL from the GWC you will get the value of net working capital.

Formula To Calculate Working Capital

Now that you are familiar with the term working capital, let’s look at the formula to calculate working capital with an example. The formula for working/net working capital is;

Working capital = Current operating assets – Current operating Liabilities

Current operating assets = Total Current assets – Cash

Current Operating Liabilities = Total current Liabilities – Debt

Here, Current assets include Accounts receivables, Marketable securities, prepaid expenses, cash, and stock. You can easily find these items from the balance sheet of the company. Whereas Current Liabilities include Accounts payables, short-term debts, outstanding expenses, and notes payables. Just deduct Cash and Debt from Current assets and current liabilities. For eg, assume a company has a COA of $70,000 and COL of $35,000. Thus, if we use the formula, the value of Working capital comes out to be $35,000. Here, the value comes out to be positive. However, it differs for all. Sometimes, you might get a value that could be minus or negative. Other times, it might be even zero. Thus, every value has a different prediction about the company.

What Is Change In Working Capital?

Let’s understand what does change in the working capital mean. The name itself gives the meaning of the word. CWC means a change in the working capital of the current year from the last year. In simple words, you’re basically trying to deduct the current year’s working capital from last year’s working capital. You need to calculate WC for two different years and then minus them. From the formula mentioned above, you can calculate working capital. The formula to calculate the change in net working capital is;

Change in NWC = Current year WC – Last year WC

How To Calculate Change In Working Capital?

Change in working capital basically tells how much has the working capital changed as compared to last year. It is not possible that the items will stay the same throughout the year. For eg, the stock produced every year (i.e 2020) is $36,500, and during the year 50% of the stock got sold. Now, in the next year (i.e 2021), there will be an addition to the stock. Thus, the total stock will be $18250 + $36,500 = $54,750. Similar is the case with other items. Therefore, there is a certain change noticed in the working capital for different years. We will see that in the working capital example in the next section. Now that you know a little bit about the change in working capital, let’s look at how to calculate the change in working capital.

- Calculate COA & COL: The first step involves the calculation of COA and COL. Basically, you try to deduct the amount of cash from the current assets and the amount of debt from current liabilities.

- Find WC for two or more years: The next step involves putting the values of COA and COL in the formula of WC and calculating the value of working capital for two or more years.

- Put the values in the formula of CWC: Now that you have the value of WC for both years, calculate the change in working capital. The formula to calculate the change in working capital is the current year’s WC minus the previous year’s WC.

Calculation Of Working Capital With Example

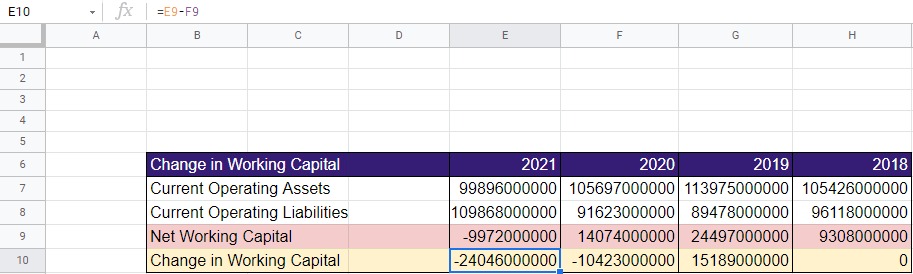

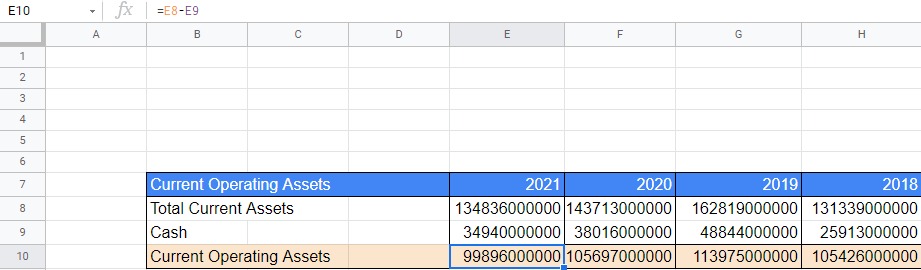

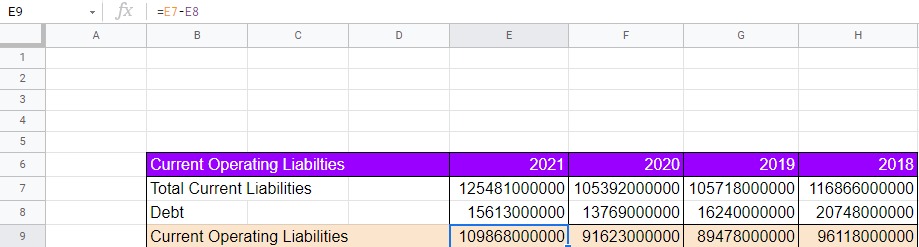

Here, is how working capital with an example of Apple Inc is calculated using Google sheets. The data is taken from Investing guru. The following are the calculation of how you can calculate net working capital along with the calculation of change in working capital.

- Step 1: The first step involves the calculation of current operating assets (COA). In order to calculate COA, you need to minus cash from total current assets. As you can see in slide 2, the value of COA in the year 2021 was $99,89,60,00,000. Similarly, in the year 2020, it was $105,69,70,00,000.

- Step 2: Now, calculate the value of Current operating liabilities (COL) for the given years. For calculating COL, deduct the short-term debt from total current liabilities. As per Slide 3, the value of COL in 2021, comes out to be $109,86,80,00,000. Likewise, you can find the remaining year’s value also.

- Step 3: The next step is to find the value of net working capital. Now, assemble the values of COA and COl together and calculate working capital. The formula for working capital is current operating assets minus current operating liabilities. Thus, the value of working capital in 2021, comes out to be -$9972000000. Here, you can see the value comes out to be negative. This indicates that the firm is out of funds.

- Step 4: The last step is to find the change in net working capital. You just need to minus the current year’s working capital from last year’s. In this example, the change in working capital in 2021 comes to be negative -$24046000000. Likewise, calculate for the rest of the years.

Can Working Capital Be Negative?

You might be wondering whether the value of working capital could be negative for the company or not. Well, this is very much possible in the books of accounts. As told, the items in the balance sheet and that too current year items are much more flexible. Today they can be present, next year they won’t be there. They tend to change within the course of time. This will cause a change in the working capital. Whereas long-term assets like machinery will stay with the company for a longer period. But, that’s not the case with current assets and current liabilities. The working capital with an example is explained above. Let’s assume your company has a debtor of $4500. Whereas last year, you had a debtor of $10600. Thus, this will cause a difference in the working capital. Similarly, even other items will see some difference.

The value of working capital can say a lot about the financial health of the company. If the value is positive, it means that the company has enough assets to pay off its liabilities of the company in one year’s period and there is excess money left in hand. If the value is negative, it means that the company doesn’t have enough money to pay its liabilities. They need to arrange funds to pay them off. Similarly, if the company has a zero value, it means the number of assets were equal to the number of liabilities of the company. However, the last case is very much rare in companies nowadays.

Why Working Capital Is Important?

Working capital proves to be an important tool for analysis for short-term periods. It tells whether the company has how much capital to fund different activities in day to day course of the business. Working capital acts as an aid to warn the company when is almost on the edge to run out of cash. Like when you have $100 and you know that you need to pay a debt of $80 to your friend and $20 for bills. This is a clear-cut sign that you are left with no money at the end. Thus, a change in working capital can be used to find free cash flow to the firm during DCF valuation. Let’s now understand why working capital is important for any business or a firm.

Helps In Decision Making

Working capital helps a lot to take correct capital-based decisions. Once you calculate working capital, it gives a crystal clear answer of how much funds are available with the company. Thus, by analyzing the need for funds in the day-to-day operations, the company can manage the funds and allocate them wisely. However, the firm also needs to see that they don’t waste the funds because it might cause the working capital to turn negative.

Helps To Tackle Cash Crunches

Any company will never want to be in a situation where they’re lacking money to pay their debts. Thus, it is necessary to calculate working capital. It will help you save beforehand if your company is going to run out of cash. A negative or zero working capital is an indication that the company will sooner or later face a cash crisis. Therefore, keep an eye on the changing working capital of your company. Also, it will create a good atmosphere in the workspace. If you pay the expenses like the salary of the people working in the company, even the employees will feel secure about the company.

Investment Planning

If you follow the above rules, your company will always have positive working capital. Thus, positive working capital tells that the company has enough funds to pay its expenses. Assume if you’re company has working capital of $25,000, this tells that the company has excess cash in hand. Now, the company has an option to either keep it as a reserve or invest it in some project. Similarly, if every year you get a positive figure, you will gain profits every year.

Is Working Capital An Asset?

Well, working capital is not an asset. It is an indicator for measuring the liquidity of the company. In other words, working capital is used to find the number of current assets left after paying the liabilities. Whereas assets are items that can earn you money in the future but working capital can’t yield anything to you. Yes, current assets are a part of the formula of working capital but working capital isn’t an asset.

Strategies To Improve Working Capital

No company would want its working capital to be negative. Thus, you need to work and keep a check on the funds so that the value doesn’t fall down. There are many ways to improve your working capital score. Now that you know why working capital is important for the company, let’s see how you can improve your negative value to a positive one. Here are some ways to improve your working capital.

Improve Accounts Receivables & Payables

Ask yourself, are your customers paying you on time? If not, ask them to pay as quickly as possible. Thus, give them different offers which will encourage them to pay faster. For eg, you can tell your customer that if they pay within one month they will get a 5% or 10% discount. This will push them to pay as earlier as possible. But why? Because this will ensure cash flow in the company and the company will have positive working capital. Also, see to it that you have good terms with suppliers and producers. See to it that your payment is made on time and as well as you receive payment on time. Thus, creating a balance between both.

Reduce Expenses

Expenses are quite expensive. You need to keep track of your expenses very often. For eg, keep a check on the office supplies and variable expenses. If you feel certain supplies are getting wasted, try to reduce the supply. See to it that the employees don’t waste them also consider asking your supplier for some buyer discount. Thus, a reduction in your expenses will boost the score of working capital.

Tax Payments

Often some companies don’t have knowledge about the tax deductions that can benefit the company. Therefore, see to it that you don’t overpay the taxes. Also, see if there are any deductions that you can earn from the taxes you’re going to pay. This will reduce the expenses to a greater extent.

Conclusion

It is important to calculate your change in working capital every year. This will allow you to keep track of how much money you are making or losing as you continue to run your business. The change in working capital will give you a better idea of whether you are making progress or not. Calculating the change in working capital can be tricky, but there are some formulas that can make the process easier to navigate. This article guides you on how to calculate working capital with the example used above, how to calculate the change in working capital over two years. Also, certain methods through which you can improve your negative working capital into a positive one.