Introduction

Earlier, the process to find the equity value was hectic. Many businesses struggled in the calculation of the equity value. But, you don’t need to worry. We make it simple for you. This article will guide you through the meaning of equity value, what does enterprise value actually means, the difference between enterprise value vs equity value, and steps for finding the equity value in excel.

Whether you are a first-time investor or a pro, the most common issue investors face is determining the equity value of the company. This is a problem because the value of the company is the most important metric to determine if it is time to sell or time to hold. Finding the company’s equity value is the first step in determining if the company is undervalued or overvalued. This blog will discuss how to go about finding the company’s equity value. It will also provide a step-to-step guide for calculating that value. Let’s check it out.

What Does Equity Value Mean?

You might have heard a lot about Equity. But, what does equity value mean? For example, assume you are owning the company. Now that you have completed many years in this industry, you decide to sell it off to some other company or bring new investors. But, you wish to value your business’s whole worth before doing so. You will be eager to know what will be the economic value of the business till now. Well, then you’re on the right track. Equity value helps in the business valuation. In other words, equity value is the total amount of money that is available to the owners and shareholders of the company. Equity value is the total value of assets and liabilities with the company. Thus, in order to find the equity value, you need to consider the total number of assets and liabilities in the company.

For the calculation of equity value, you need to multiply the market value per share by the number of shares of the company. Equity value is the total value of the company. It is also referred to as the market capitalization or market value of the equity. Equity value helps to know the worth of the company. But, enterprise value also means the same. What’s the difference? Well, we’ll discuss the difference between enterprise and equity value in the further sections of the article.

Types Of Equity

Equity value is very important for the owners of the company. It helps them to value the business in case they feel like selling the company. Now that you know what equity value means, let’s look at the types of equity value.

Market Value

The market value of equity is the total market value of the outstanding stocks of the company. In simple words, it is the value of the equity in the market. It is also known as market capitalization. It is calculated by multiplying the number of shares by the market price of the share. The market value might change during the day. This is because the stock prices keep on rising and falling throughout the day. Just like any day the company announces certain news regarding earnings, dividends, or some future plans. You will get to see the effect on the share price first. If it is positive news, prices might rise. Similarly, if there is ill news, it will drop down and will eventually low down the market cap also.

The formula for the market value of the equity is,

Equity value = Number of outstanding shares x Current share price of the stock

You can get the values from any stock exchange. Let’s have an example of this. Assume, CVS Health has outstanding shares of $1.31 billion and the market value per share is $102.97. This data is taken from the Nasdaq stock exchange. Outstanding shares are basically, the number of shares held by the owners of the company. Thus, the market value of equity will be $134.8907 billion.

Book Value

The name itself says the meaning of the word. The book value of equity is the value of the equity in the books of accounts. In simple words, in the balance sheet, the value of equity you got on the liability side, is the book value. It is also called an Accounting equation. Thus, it is the amount that is left after selling all assets and paying all liabilities. The formula for calculation of equity value through the book value method is,

Equity value = Total assets – Total Liabilities

Again, you can easily get these values from the balance sheet of the company. One biggest disadvantage is that you can’t use this formula for valuing the company. For accounting purposes, this method is used. If you want to value a company, you should use the third formula that is used in the DCF model. The formula to find the equity value through business valuation is,

Equity value = Enterprise value – Total Debt + Cash

Formula For Calculation Of Equity Value

Now that, you know what does equity value means? let’s look at how to use the formula to find the equity value. The formula for the calculation of equity value in a company is as follows.

Equity Value = Total Assets – Total Liabilities

Or, Equity value = Number of outstanding shares x market value per share

Equity value = Enterprise Value – Preferred Shares – Minority Interest – Outstanding Debt + Cash & Bank

The first equation is also called as accounting equation. Thus, it gets used for accounting purposes. Whereas the second formula is the market value of the equity. And, finally, the third formula gets used for business valuation. Thus, if you want to value a business, you will use the third formula. Here, you will get the values of these variables easily from the balance sheet. If you have ever seen a balance sheet, you might have seen that assets are on the right side whereas liabilities are on the left side. The left side has debts, loans, and equity. For the third formula, you will need to calculate the enterprise value. Later on, you will learn how to find it. Put the values in the formula, you will the value of the equity of the company.

What Does Enterprise Value Mean?

If you wish to use the business valuation method, you need to find the enterprise value. But, what is Enterprise value? Well, Enterprise value is the total value of the company. If a company wants to do a takeover, then enterprise value is the best value to calculate. Thus, to find financial ratios, you can use enterprise value. It helps to measure the performance of the company. Enterprise value includes the market cap of the company, as well as debts, and cash. While equity value ignores cash and debt figures, EV does not do the same. EV basically tries to add cash and deduct the debt figures. Therefore, if a company wants to do a takeover, it will deduct debt. Because the buyer will pay the debt of this company as per the terms.

In DCF valuation, enterprise value is the main element. The next process after the terminal value is the calculation of enterprise value. Just like every coin has two sides even, this method also has some cons. This method can be a little hectic for capital-intensive industries. These are companies where the need for capital is very large. For eg, oil, gas, power companies. In case we calculate the EV of these companies, it would be low. Because a large amount of capital comes from debt. So, if we calculate the EV, it would turn out to be either negative or zero. Whereas, for companies with low debt, the scenario would be different. Therefore, this method would be useful if you use it for companies in the same industry.

Formula For Enterprise Value

Now that you know what does enterprise value means, let’s look into the formula for the calculation of enterprise value.

Enterprise value = Market Cap + Total Debt – Cash

Here, you can easily find the value of the Market cap using the equity market value formula. Whereas other values you can get from the balance sheet. If you had observed, you will find that total debt gets added here. Whereas in equity value, debt gets deducted and cash gets added. For eg, the market cap/equity value of Amazon is $15,73,858.881. Total debt is $116,39,50,00,000 and cash is $36,22,00,00,000. Thus, the Enterprise value is $81,74,88,58,881.

Enterprise Value Vs Equity Value

You might be wondering, enterprise and equity value sound the same. They have a lot in common. Then, why are both two different terms? Well, let’s burst the facts of Enterprise vs Equity value.

Equity value | Enterprise value |

Equity value is the total value available to Equity holders | Whereas, Enterprise value is the total value available to all shareholders. |

Equity value might not be so accurate. It is just a snapshot of current and future values. | It is a more accurate method |

Company can use for investing in equity and equity valuations | It is preferred in processes like mergers, acquisitions, and leveraged buyouts. |

Here, debt is deducted and cash gets added. | In Enterprise value, Debt gets added and cash gets deducted. |

How To Find The Equity Value?

Now that you know about the equity value and enterprise value, let’s look into the method for the calculation of equity value. There are certain steps you need to follow while calculating equity value through different methods. They are as follows.

Find The Market Value Of The Equity

The first and the foremost step involves finding the market value. You can easily find market value using the formula above. Firstly, you need to find the number of shares of the company. Just type, for eg, Amazon’s number of shares, you will get the results. Similarly, also search the company’s current share price. Once, you get the values, use the formula,

Market Cap = Number of shares x share price

Calculate The Enterprise Value

The next step includes finding the enterprise value. Use the market cap calculated above in this formula. You can use the formula and find the value. This value will be further used to find the equity value. The formula for enterprise value is,

Enterprise value = Market Cap + total debt – cash

Find The Preferred Shares/ Stocks & Minority Interest

Preferred stores are also known as Preference shares. But, what are preference shares? Preference shares are basically shareholders who get the dividend first than other people. If we look into the case of Amazon, they don’t have any preferred stocks. Even, Apple doesn’t have any preferred stocks. While we look into minority interest, even that is absent in both cases.

Calculate Outstanding/Net debt & Cash

Net debt is basically total debt less debt paid. If you want to access the direct value of net debt and cash of any company, you can visit Investingguru or any finance website like Google Finance or access the company’s reports.

Club All The Values

Now that you have all the above values, you can easily find the value of equity. Just put all the values in the formula. The formula for the calculation of equity value is,

Equity value = Enterprise Value – Preferred Shares – Minority Interest – Outstanding Debt + Cash & Bank

Example Of Equity Value In Excel

Here, this is an example of Amazon incorporation where equity value is calculated. The data is taken from Investingguru and the calculation is done in Google sheets.

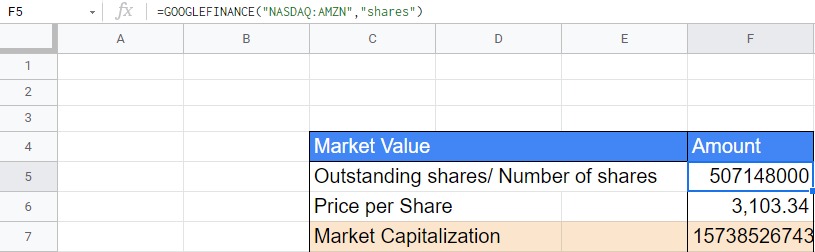

Step 1: The first step is to calculate the market value of the equity or the Market Cap. Here, by using the function [=GOOGLEFINANCE(“NASDAQ:AMZN”,”shares”)], you will get the number of shares. For the share price, you can just type Amazon’s current price. Use that value and multiply it by the number of shares. You will get the Market Cap value. Here, the value comes out to be $15,73,85,26,74,320.

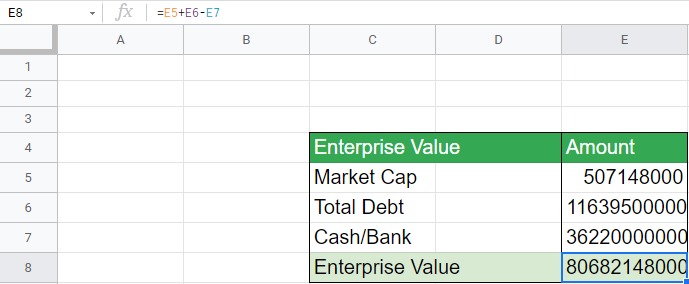

Step 2: The next step is to calculate the Enterprise value. You can get access to the values from the Balance sheet and get the values of Total debt and cash. Put the values in the formula and the Enterprise value comes out to be $80,68,21,48,000.

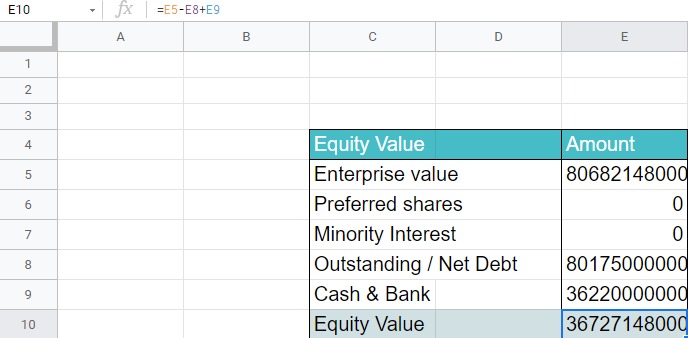

Step 3: The final step is to put the values in the formula. But, before that, you need to look at whether the company has any preferred stocks or any minority interest pending. Well, in this case, Amazon doesn’t have any of these values. The values are zero. Put all the values in the formula and the value comes out to be $36,72,71,48,000.

Interpretation Of Equity Value

Well, equity value can be a potential tool for calculating the value of the company. This method can help us to find the equity value of the company in today’s time. It is the total value available to the equity shareholders. But, sometimes this value might not be stable. In other words, if the share price of the company rises or falls, the equity value will also fluctuate. Let’s understand it from an example. Assume, that the stock price of the company today is $500.32, and the number of shares is 5000. Then, the market value of equity will be $25,01,600. But, due to some news, the price fell to $300.50. Now, the equity value will be $15,02,500. Almost 60% decrease in the equity value. Therefore, the equity value might be subjective to external and internal factors.

Conclusion

This article explains the process of finding the equity value of a given company. It explains the steps that you need to follow, including how to calculate the enterprise value. Also, it explains the importance of each step in the process and the difference between enterprise and equity value. Thus, it also includes all the calculations that you need to make, including the final equity value of the company.