Introduction

Mckesson case study is an ongoing tool for investors and researchers in the pharma sector. But, do you know about the Mckesson and Robbin scandal that shocked the whole nation? Well, you have landed on the right page. Here is a Mckesson case study that analyses the business model and how it has performed over the years. This article will also guide you through the Mckesson case study that covers the Mckesson revenues and net worth, the different subsidiaries and competitors of Mckesson Corp, Mckesson corporation stock price history, and lastly the financials of the company. Let’s check it out.

Brief About Mckesson Corporation

Mckesson is an American pharmaceutical company that deals and supplies healthcare and drugs. John McKesson and Charles Olcott founded the Mckesson corporation in 1833. Surprisingly, the company is almost 189 years old. They also have international operations in Asia, Europe, and Canada.

At present, their headquarters are in Texas, U.S. According to Fortune Global 500, Mckesson’s rank was 12th position, whereas the 11th position went to Berkshire Hathaway. Currently, in 2021, there are 76,000 people working in their Mckesson company while in CVS health they are more than 2,03,000 people working there.

Meanwhile, Mckesson has a network of 750,000+ providers and over 50,000 pharmacies across the world. In 2021, the Mckesson revenues turn out to be $238 billion. In the next section of the article, we have tried to explain the Mckesson case study and the success that drove the Mckesson worth to billions in today’s time.

History Of Mckesson Company

Now that you know a bit about Mckesson company, let’s drive deep into the history of Mckesson company. Although you know that the company’s name was Mckesson Corporation but in the early days, it was quite different. In the early years, Charles Olcott started a company called Charles M. Olcott in 1828.

Later on, in 1833 they renamed the company Olcott, McKesson & Co. This company used to import and do wholesale business of supplying drugs everywhere. As the company grew, Daniel Robbins joined the company. Eventually, after the death of Olcott, the company changed its name to “Mckesson and Robbins”. But, who knew, down the lane was coming to the biggest scam of the 20th century.

The Mckesson and Robbins scam is considered to be the biggest scandal of the 20th century. This forced major changes in the audit procedures. Apart from this, SEC made it compulsory for companies to have audits from outside directors.

Later, in 1967, Foremost Diaries acquired Mckesson and Robbins company in a hostile takeover(takeover happens against the wish of the acquiring company). Eventually, the company sold its dairy operations and changed the name to McKesson Corporation.

In the next few years, i.e in 1999, Mckesson Corp acquired HBOC and both started working jointly. Likewise, in 2001, the company changed its name to Mckesson. To date, there are many companies Mckesson brought and this has increased the net worth and revenues to a greater extent.

Business Model Of Mckesson

Mckesson is a company that is 189 years old and is doing pretty well in the pharmacy business. You might also be curious to find the business model of Mckesson. Well, the following is the business model that forms a major part of the Mckesson case study.

Targeting The Customers

Mckesson has a niche segment, meaning there targeting the customers at a major. They have more than 750,000+ providers and over 50,000 pharmacies worldwide. Apart from that, the company has 10,500 owned and banner pharmacies across Canada and Europe. Mckesson earns a majority of revenues from the pharmacies they operate. Besides that, the U.S. Pharmaceutical segment of Mckesson also grew revenues 4% to $189.3B in the year 2021. Also, CVS Health is also a loyal customer of the Mckesson corporation.

Patents & Technology

Being in the pharmaceutical sector, there is a lot of research happening in the company. Till now, there are 954 patents globally. Out of 954 patents, 659 are inactive and the rest 295 patents are active. The majority of patents are filed in the US driving the number to 257 patents. In 2021, the company invested $74 million in the R&D sector. This indicates that the R&D team is active and is consistently bringing up new technologies in the pharma sector. This includes wireless data transmission, human-machine connection, etc, Thus, this is increasing the overall Mckesson net worth.

Partnerships

Mckesson has always believed in knowledge sharing between people. Also, McKesson partners with life sciences companies, manufacturers, providers, pharmacies, governments, and other healthcare organizations. Therefore, they have also partnered with many other brands. It includes Vanderbilt Health Rx Solutions, World Vision USA, MySQL, Walmart, and many more. Apart from them, Mckesson also took franchise and license of various products and drugs in recent years leading to an increase in Mckesson net worth.

Financial Reports Of Mckesson Corporation

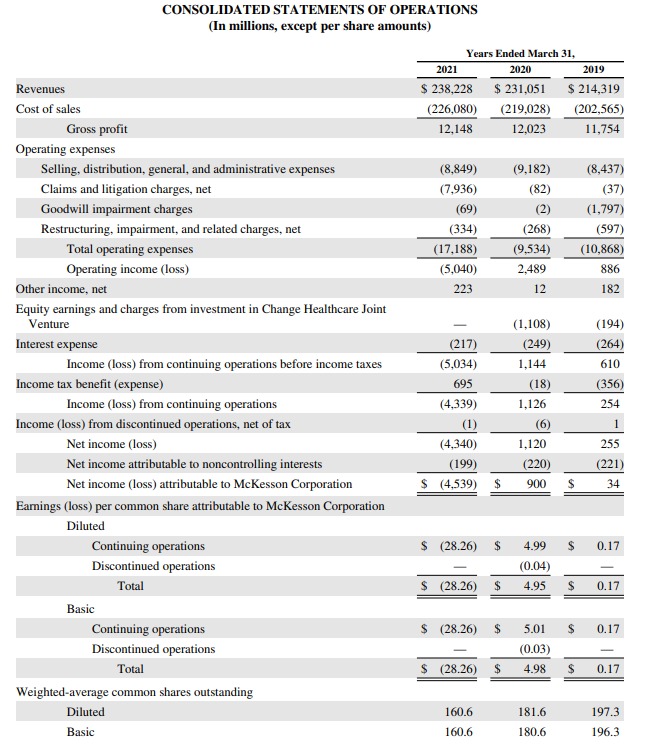

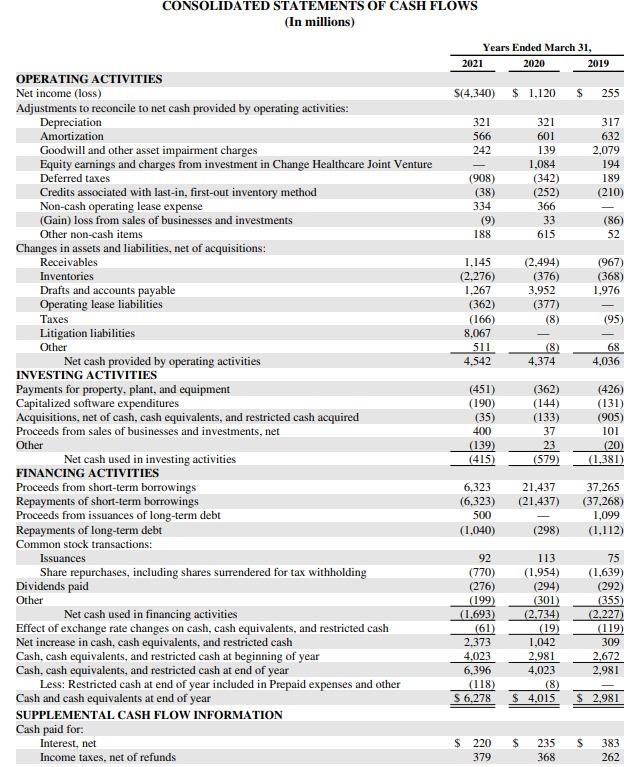

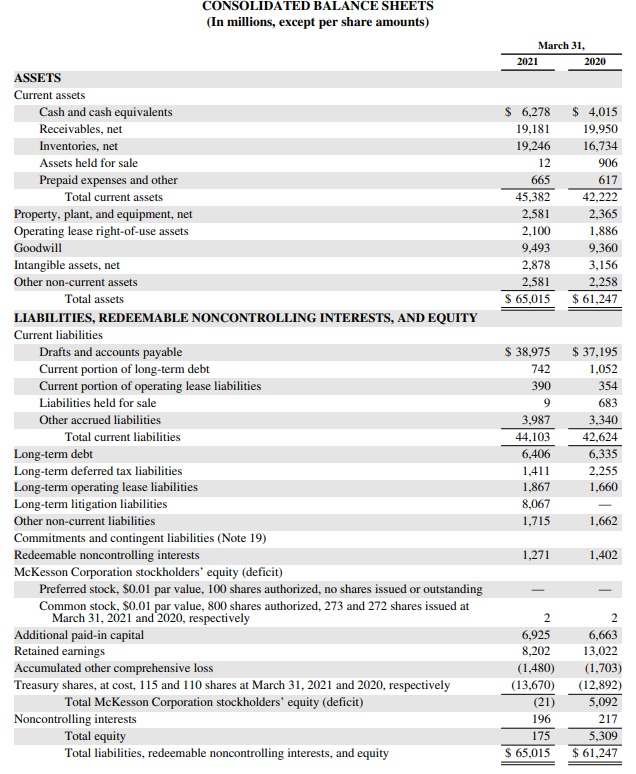

Here are the annual reports of the Mckesson corporation for the year 2021. These annual statements include Income Statements, Cash Flow Statements, and Balance Sheets. Let’s check it out.

1. Income statement: Mckesson revenues in the year 2021 were $238,228 million, a slight increase of 3% as compared to 2020. In 2020, Mckesson revenues were $2,31,051million. In the year 2020, the company had earned a net income of $900 million but that was not the case in 2021. Mckesson suffered a Net loss of $4,340 million in 2021.

2. Balance Sheet: Looking at the balance sheet, the company did bring some changes in its assets and liabilities. The company brought some land in 2021, taking the number from $151 million to $156 million. Also, some repairs and improvements were done for $1745 million in 2021. The total assets in 2021 were $65,015 million whereas in 2020 it was $61,247 million. A change of 6.15% was noticed in 2021 as compared to 2020. The total liabilities of Mckesson company in 2021 were $63,569 million.

3. Cash Flow Statement: Analyzing the cash flow statement of the company, the following changes are noticed. In the year 2021, there was a huge change in the inventories taking it to a negative figure of $2,276 million. The net cash from operations was $4,542 million whereas, in 2020, it was $4,374 million. Also, the cash flow from investments decreased in 2021 to $415 million. Eventually, the Cash at the end of the year was $6,278 million. An increase of 56.3% as compared to 2020.

Mckesson Corporation Stock Price

The above image shows the graph of Mckesson corporation stock prices. In the NYSE, the Mckesson stock ticker symbol is MCK. Mckesson shares got listed in the year 1994. The stock price of Mckesson on November 30, 1994, was $15.69. Soon after that, the prices formed a small mountain taking the price to $91.63 on September 29, 1998.

However, in April 2000, the price fell to $16.94. The Mckesson corporation stock price, after that, saw many ups and downs in its history. From 2001 to 2008, the Mckesson price of the stock ranged between $37 to $38.

The real rally of rising prices started from 2008 onwards. The Mckesson corporation stock price on February 28, 2014, was $177.05. Likewise, on May 28, 2015, the price reached a high of $237.23.

Soon after that, the Mckesson corporation stock price saw a slight fall in number. Meanwhile, there were quite lows and highs noticed. During the period of 2017 to 2021, the stock prices ranged between 139 and 191. The current Mckesson corporation stock price as of March 7, 2022, is an all-time high of $278.53.

Subsidiaries Of Mckesson Corporation

In total, there are 65 subsidiaries of Mckesson corporation. Thus, enabling the McKesson net worth a 10% increase from $139 to $153 million. Likewise in 2021, they announced separation with Change Healthcare JV. The top subsidiaries of Mckesson are McKesson Provider Technologies, McKesson Medical Supplies, Equipment, Health Mart, etc. The following is a brief description of the subsidiaries of Mckesson. Let’s check it out.

McKesson Provider Technologies | Basically a Software development company of Mckesson. |

McKesson Medical-Surgical | Offers various national healthcare brands, along with Mckesson products. |

Health Mart | Network of 4000+ pharmacies across the country. |

McKesson US Finance Corporation | Financial division of Mckesson Corporation. |

Celesio | Also known as Mckesson Europe AG. It is a provider of logistics services to the Mckesson pharmacies. |

Competitors Of Mckesson Corporation

Being one of the oldest and largest pharmaceutical companies in the US, there are many competitors they have to face. These form an important element of the Mckesson case study. The following are the competitors of the Mckesson company. Let’s have a look.

Walgreens Boots Alliance

Walgreens Boots Alliance is a leading retail pharmacy company. The company was formed in the year 2014. It also supplies various medicines and drugs related to fitness and health. The total revenue of WBA in 2021, was $134.97 B. Likewise, the number of employees of WBA is 277,000. According to Fortune Global 500, WBA got 36th rank whereas, in Fortune 500, they achieved 19th position.

Cardinal Health

Cardinal Health is a clubbed company that offers various products, medicines to the healthcare system. Besides that, they also provide customized solutions for hospitals, healthcare systems, and patients. Cardinal Health was formed in 1971. Likewise, the total number of employees of Cardinal Health stands at 48,000 in 2021. The total revenue of the company in 2021 stands at $45.457B. Apart from this, the company has operations in more than 35 countries worldwide. According to Fortune Global 500, Cardinal Health got 14th rank in the year 2021.

GlaxoSmithKline

GlaxoSmithKline is a British company that makes various drugs and medicines. The company was founded in 2000 through a merger of Glaxo Wellcome and SmithKline Beecham. Currently, there are more than 94,066 people working in their company. Besides that, the total revenue in 2021 was $34.11 billion. At present, GSK operates in many countries worldwide. According to Fortune Global 500, GSK got 264th rank.

Conclusion

Mckesson delivers high-quality healthcare information technology and services to public sector organizations and other institutions. The company has been in the business for more than 70 years. Thus it is recognized for its expertise in healthcare IT and this has increased the Mckesson net worth. It offers a variety of support and consulting services to states, and countries. Likewise, the Mckesson corporation stock price is also at the peak of the charts. This article discusses the Mckesson case study. Also, the successful business model of Mckesson has driven the Mckesson net worth revenues. Apart from this, the subsidiaries and competitors of Mckesson Corp have also explained above. We, hope this article was useful to you. If you have any questions regarding the Mckesson case study, you can comment down.

FAQs

In 1855, the Mckesson and Robbins company became one of the wholesale companies to manufacture drugs. Soon the company was sold to Frank D. Coster. Coster’s real name was Philip Musica. But, Coster was not the right person handling the company. He turned the whole company into a scandal. He used to bribe the dock customs about the weight of the ship. Likewise, the business grew but it couldn’t stand long. Eventually, McKesson & Robbins treasurer Julian Thompson discovered the distribution company was fake.

In 1938, Musica and his team were also arrested. The SEC got an alert and thus strictly told all the public companies to audit their companies from outside directors. Therefore, Mckesson and Robbins turned out to be the biggest scandal of the 20th century.