Introduction

Toyota motors corporation is one of the largest companies in Japan and people are investing heavily in it. But, do you know the real business of Toyota? Well, you are on the right page. This article will guide you through the company’s business model, its history, Toyota’s annual reports analysis, analysis of Toyota’s share prices, and lastly, answer the question about whether you should invest in Toyota or not.

Toyota is the biggest car manufacturer in the world and is a pioneer in the field of making reliable cars. The company has been in operation for over 80 years, producing more than 5 million cars every year. This Japanese multinational company has become a synonym for quality, safety, and reliability. But does it make a good investment? To find out more about this, read on.

Brief About Toyota Motor Corporation

You might all be knowing this multinational motor company Toyota motors. But, do you know the reason why this company was named Toyota? Well, keep on reading further. Toyota was started by Kiichiro Toyoda in 1937. But, his father Sakichi Toyoda was the owner of the company at that time. There was a public competition held where people has to come up with new names and logos for the company. It was then that the company thought of changing its name. Thus, the company’s name was changed from Toyoda to Toyota. Do you know why? Because while writing this name in Katakana (i.e Japanese script), it takes 8 strokes (トヨタ). And, surprisingly, eight strokes are lucky in East Asian culture.

Before actually selling vehicles, they used to sell sewing machines. It was then in 1935 when their first vehicle got launched. You might be surprised to know that the Toyota vehicle got used to tow a 60-ton space shuttle. This has made it a powerful vehicle to date. Until now, Toyota Motor Corporation has successfully created 365,000 jobs in the United States.

Growth Of Toyota And Its Journey

The history states back to the year 1924 when Sakichi Toyoda started Loom production. Slowly, this business started growing. Thus, in 1934, they started Toyoda Automatic Loom Works where automobiles were made. Initially, Kiichiro has less experience in making automobiles, so he focused more on making trucks. G1 was the name of the first model of this truck. The G1 model got sold at ¥2,900, ¥200 cheaper than the Ford truck. In April 1936, the first passenger car got launched. The price of the car was ¥3,350, ¥400 cheaper than Ford or GM cars. This gave an advantage to Toyota. In 1936, the company ran a public competition, and they landed on Toyota. Because Rizaburo Toyoda who was married to Kiichiro’s sister thought that Toyota sounds clear. Toyoda meant fertile rice paddles and might represent the company as old-fashioned. Thus, the company adopted this new name on August 28, 1937.

During the period of 1940-1950, there was a war-like situation in japan. This had forced Toyota to almost close down its production. Kiichiro’s cousin along with others decided to tour the Ford motor company. There they got trained and this was going to be a turning point for Toyota Motor Corporation. In 1957, Toyota entered the U.S market. They launched their first model Toyopet which was a failure. But, in 1965, it again entered the market to mark its success on the board. Later, Land Cruiser also got a huge success. Toyota acquired companies such as Hino Motors, Ltd. (1966), Nippondenso Company, Ltd., a maker of electrical auto components; and Daihitsu Motor Company, Ltd. (1967). Today, there are many plants of Toyota across the world that drive the success of the company.

Core Principles Of Toyota

According to Fortune Global 500, Toyota motors bagged the 9th position. Whereas Ford is in 4th position as compared to Toyota. Now that you know a brief history of Toyota motors corporation, let’s look at the core principles of Toyota. They are as follows.

- Respecting the culture: Toyota tries to keep a balance between the work and the culture of any country wherever they are operating. They see to it that the company doesn’t try to break the rules of the country. Also, they respect the culture of that country. For eg, a country like India, which is known for its culture.

- Creating new machines: The main USP is the making of new cars and vehicles. The company can’t just launch the same model for years. They need to create new features and models using the latest technology.

- Clean and Safe products: Toyota tries to create safe and clean products for all. Toyota has created such vehicles as hybrid electric vehicles, hydrogen fuel cells, etc. They are doing several attempts to reduce global warming in the countries.

- Develop Corporate culture: The main aim of any company is to create a healthy environment. There must be good bonding between the teams and the people working there. They want their employees to work as a team. This will boost the country’s success. Thus, the annual reports and share prices of Toyota will also do good.

- Working with other partners: In order to grow your business, you need to work with other companies also. Even Toyota works on this principle. Since they are into the automobile industry, they try to make bonds with other companies. This will help in technology sharing. Thus, the company will progress.

Business Model Of Toyota Motor Corporation

As everyone is now aware of the fame of Toyota motors, have you ever wondered what would be the business strategy behind it? What has driven Toyota’s share prices to rise? Well, keep on reading further. The interesting fact is that 80% of Toyota’s sold 20 years ago are still on the road today. The following are the business models of Toyota.

Toyota's Way

You might be thinking what is Toyota way? Well, it is a set of principles that Toyota follows in the company. These principles should be applied in day-to-day work because they will improve the performance of the company. For eg, assuming you develop an application. Many people are using this app, but they face some bugs issues. Now, you have two options, either updating your app or doing nothing. If you’re are wise enough you will improve your app. Similarly, even TMC tries to do the same. This Toyota’s way works on two pillars. The first is continuous improvement and the second is respect for the people.

The continuous improvement is again divided into challenge, kaizen, and genchi genbutsu (take correct decisions). Challenge means long-term vision, whereas kaizen means continuous improvement. TMC tries to think from the eyes of the future and likewise, makes the decisions. They don’t want to give bad experiences to their customers. Thus, this has been an important model for TMC.

Technology

Toyota has done much innovation in their products. This has boosted the sales of the company. the company has tried to make the vehicles in the expected time. Thus, this has allowed the production not to stop. Every year Toyota invests $1 million in the research teams. Toyota wants to create vehicles that will have more unique features than others. To date, TMC has created hybrid vehicles, vehicles that work on electricity, vehicles that use fuel cells to operate, etc. Since 1997, the company has sold more than 15 million hybrid vehicles till date. But, what are hybrid vehicles? Well, hybrid vehicles are basically vehicles that work on both fuel and electricity. It is a combination of both powers. In 1990, there was a law passed that the automakers will have to make vehicles that emit zero pollution.

Following this, there were electric cars launched which made them quite successful. But, the law was taken back. The third most innovative vehicle was the hydrogen fuel cell. Basically, the SUV car had a fuel stack that was filled with hydrogen. It can deliver a range of 435 mi (700 km). Toyota released 5,600 patents in 2015, but in 2020, they were made free to use. Toyota has been the tortoise in the race of adapting to smart car technology. They started making smart cars in 2017, where they have a self-driving technology named Chauffeur and Guardian. Chauffeur basically assists in the self-driving and Guardian is a driving assist system.

Partnerships

Just like every person needs another person. Even, companies need to make partnerships with other companies. You might be thinking, why is there a need to make partnerships with other companies? Well, there are two main reasons. The first reason is that the other company might give you some rights to use their technology. In other words, a company has some patents that might be useful for your company. So, if you have an agreement with them, you can use the technology in your cars. The second reason is that, If you have partnerships with brands, companies and you sponsor them, you will earn money in return. And that’s the main reason why Toyota has acquisitions and partnerships with companies. In 1960, Toyota motors corporation acquired Hino Motors. Hino Motors used to manufacture trucks in Japan.

Whereas in 2016, Company acquired Daihatsu. It used to make various bikes and vehicles in the country. By 1969, the company had produced 2 million vehicles. Toyota has been investing in the Olympic games for a decade. Also, Toyota has been one of the sponsors of Cricket Australia. They have even been organizing concerts and music festivals in the countries for over 25 years. In 2016, Toyota proudly became a partner of the Crow’s AFLW team. Therefore, this has boosted Toyota’s share prices and the figures in the annual reports.

Who Are The Competitors Of Toyota

Everyone has some other competitor or rival. The competition allows us to be better. Even companies have some rivals. Therefore, we will now discuss who are the competitors of Toyota company. You might be surprised that Toyota has many rivals in today’s time. But, the biggest competitor is Ford motors. You might have heard about it. But, what makes the company to the top? Well, the company has more than 1,86,000 employees. Whereas the valuation of the company stands out to be $70.1 billion. It has sold more than 5.5 million vehicles to date. The second competitor is Volkswagen. It is a german based company. In 2019, Volkswagen earned a total revenue of US$252 billion, 40 percent of which came from China. The reason why people choose Volkswagen is that they are cheap, safe, and well assembled.

Lastly, the third main competitor is General Motors. It is an American multinational company and one of the top rivals of Toyota. Generally, according to Fortune 500, they bagged 13th position for having the highest revenue. In 2020, General motors have sold more than 6.83 million cars worldwide. But, still, Toyota has some pros over them. Toyota’s innovation, providing vehicles at a cheaper rate and fast supply chain has made them survive in this market.

Revenue Avenues Of Toyota

There might be questions like, should I invest in Toyota or not? But, before you decide that, you need to know from where the company is earning money. Here are the following sources from where Toyota motor corporation earns money.

- Vehicles: Most of the revenue of the company comes from the sale of vehicles. Approx 88% is from the sale of vehicles. They sell automobiles such as cars, trucks, minivans, buses, forklifts, etc. Apart from these, Lexus, one of the luxury brands also contributes to the revenue.

- Financial services: Toyota provides various services such as loans, credit cards, vehicle leasing, etc. Almost 7.9% of the money was earned from these services as per the annual report of Toyota.

- Other services: The rest of the revenue i.e 4% comes from investments in other companies. Also, partnerships with other companies have helped the company to earn money.

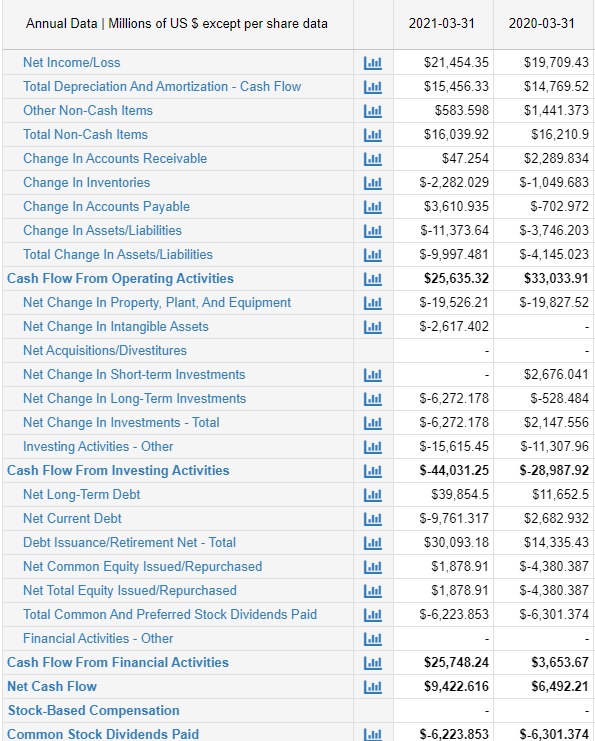

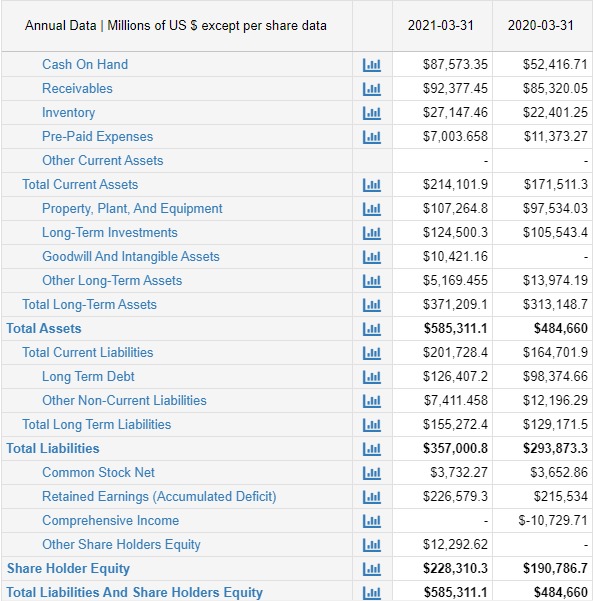

Analysis Of Toyota's Annual Report

Here are the financial statements of Toyota Motors Corporation. This carousel includes the Income statements, Cash Flow Statement, and Balance Sheet of the company in the year 2021.

According to the annual reports of Toyota, the company recorded a revenue of $290.230B as of 2021. There was an increase of 20.33% as compared to last year. The price-to-earnings ratio (PE) comes out to be 9.39 which tells that the company is a value company. In other words, this company will give you fair returns if you purchase its shares. Whereas the PE ratio of Ford Motors is 10.10. Likewise, the current ratio comes out to be 1.07. Whereas Ford’s current ratio is 1.20 almost on the same path. If the current ratio is above 1, it states that the company is capable to pay its short-term debts.

The current dividend payout of Toyota is $3.73 and Ford’s is $0.40. Thus, the dividend yield of TMC as of February 2022 is 1.97%. As per the annual reports of Toyota, the net profit margin comes out to be 9.99%. The net profit margin is increasing in the past few years as compared to other companies.

Share Prices Of Toyota Motor Corporation

Now that you know about the financial figures of Toyota’s annual reports, let’s look at the share prices of Toyota. The history of Toyota’s share price started back in 1982. In Japan, it got listed in the year 1949 (Toyota’s share prices in that year are not available). Whereas the company got listed on the New York and London exchanges in 1982. In September 1982, the share prices of Toyota was $5.3219 with a volume of 170k. The prices were rising slowly and steadily. On March 31, 2000, the share price was $104, the volume of 213.0k. There were many ups and downs in the prices. Thus, if we look at the past few months, the highest peak price was $211.37. According to Nasdaq, the share prices of Toyota on February 16, 2022, was $190.30.

According to the analysis, the share prices of Toyota are slowly rising up. In other words, the stock prices in the past few days are forming a steep slope that is moving upward. Therefore, it would be better if you buy the stocks now. You will earn good returns in the future.

Should I Invest In Toyota?

So there you have it, the complete analysis of whether or not you should invest in Toyota. Overall, we think the company’s stock is a great investment and we would recommend it to anyone looking for a solid stock to add to their portfolio. Toyota is always innovating and expanding its business. Thus, it means that its future is looking bright. It is also worth mentioning that Toyota has a strong shareholder-friendly record which is another reason we feel that you should invest in Toyota. Overall, we feel that Toyota is a great long-term investment and wouldn’t hesitate to buy some shares.

Conclusion

Our Toyota analysis means we have covered all of the most important aspects of the company. We have looked at their financials and future projections and looked at the potential threats and opportunities facing Toyota. From all of this, we have been able to answer the question, “Should I invest in Toyota?”. Overall, we have determined that you should invest in Toyota. The company has many strengths and, while there are some risks facing the company, these are outweighed by the opportunities. We would therefore recommend that you buy shares in Toyota because the graph of the company will rise up in the coming years.