Introduction

Adjusted EBITDA is one of the most important and most used financial metrics in the business world. Understanding what Adjusted EBITDA is and how to calculate it is vital for every small business owner and investor. But, do you know how to calculate EBITDA? While calculating Adj EBITDA, what all items are deducted from EBITDA? Well, you’re on the right path. Thus, in this article, we will discuss in detail what Adjusted EBITDA is, how to calculate Adjusted EBITDA, the importance of Adj EBITDA, and also what it can be used for. Let’s check it out.

What Is EBITDA?

EBITDA or Earnings Before Interest, Tax, Depreciation, and Amortization is an important tool to determine the earnings of the company. In other words, when you add items such as Interest, Tax, Depreciation, and Amortization to net income, the value you get is called EBITDA. Many companies consider EBITDA as an important metric for measuring the profitability of a company. Besides that, it acts as a quick method if you want to know how much the company has earned. Similarly, you can calculate the EBITDA margin as it can be a useful tool for comparing with the competitors.

Some companies try to highlight their EBITDA when the value of their net income is not so good. On the other hand, EBITDA is very useful for companies involved in research and technology when having a conversation with investors and analysts. This is because, these companies invest a lot in assets, machines, and patents and these payments form a part of Amortization. However, many investors argue that it might not be a good tool. Because in spite of giving you the number of earnings of the company, it does not include the cost of plants, equipment, and other assets. Therefore, we calculate Adjusted EBITDA.

Formula For Calculating EBITDA

Now that we know what is EBITDA, let’s look at the formula on how to calculate EBITDA from net income. For calculating EBITDA, you need to add Interest, tax, and D&A to the Net income. The formula for calculating EBITDA is;

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization (D&A)

Here, Net Income is the income you get after deducting expenses from the revenue. Interest Expenses are the Interest you pay on debts and loans. You can easily find other items such as Taxes and D&A in the balance sheet and Cash Flow Statement of the company. Likewise, if you want to know how to calculate EBITDA margin, this is the formula;

EBITDA margin = EBITDA/ Net Sales

You might be thinking, can EBITDA be negative? Well, EBITDA can be positive as well as negative. Positive EBITDA tells that the company is doing well and they have excess earnings. Whereas if the EBITDA is negative, it tells us that the company is facing some financial issues and thus, has poor cash flows. Basically, in startups, the EBITDA is usually negative because in the starting few years they don’t make enough profit.

What Is Adjusted EBITDA?

One of the major drawbacks of EBITDA was that it did not include many items that could actually affect the earnings. For that reason, Adjusted EBITDA was introduced. Adjusted EBITDA is a type of EBITDA where you add and deduct some items from EBITDA. In simple words, you try to adjust the EBITDA of a company by adding and deducting some items that do not occur on regular basis. There is much importance of adjusted EBITDA among the management teams. Similarly, the casino industry is using Adjusted Property EBITDA in the past few years. It does not include expenses such as corporate or pre-opening. For eg, if a company has paid extra rent or there are unusual expenses, they will also add them to the EBITDA. Likewise, if the company has gained some income, it should be deducted from EBITDA. The formula for calculating Adjusted EBITDA is;

Adjusted EBITDA = EBITDA ± Adjustments

Similarly, we can also calculate Adjusted EBITDA margin for a company. Thus, Adjusted EBITDA margin formula is;

Adjusted EBITDA margin = Adjusted EBITDA/ Gross Revenue

Items Included In the Adjustments

For calculating Adjusted EBITDA, certain non-recurring items are added or deducted from EBITDA. Because when you calculate EBITDA, certain items get ignored. Therefore, we need to make some adjustments so that we get the correct value of EBITDA. Basically, the company is removing or adding certain items that will give us a correct value of EBITDA. Above all, it is not necessary for the companies to calculate Adjusted EBITDA under GAAP. If they want to do some analysis, they can use this. There are certain items that can increase or decrease the value of EBITDA. The following are the items included in the Adjustments. Let’s check it out.

Add to EBITDA | Less from EBITDA |

Litigation Expenses | Gain from the sale of asset |

Excess owner’s salary | Excess rental Income |

Goodwill Impairment | One-time settlement of Lawsuit cases |

Excess bonuses paid to owners | Excess income received |

Donations | |

Any other type of excess expenses |

How Do I Calculate Adjusted EBITDA In 3 Easy Steps?

Now that you know what does Adjusted EBITDA mean, let’s look at how to calculate the Adjusted EBITDA in 3 easy steps. The following are the steps for calculating Adjusted EBITDA. Let’s have a look over it.

Step 1. Calculate EBITDA

The first step is to calculate EBITDA. For that, you need to calculate the Net income. The formula for net income is;

Net Income = Total Revenues – Total expenses

Likewise, now calculate the value of EBITDA. From the income statement, you will get the values of Interest expenses and Taxes. Similarly, from the Cash flow statement, you will get the value of Depreciation & Amortization (D&A). Use the formula for EBITDA and calculate the value of EBITDA in excel;

EBITDA = Net Income + Interest expense + Taxes + D & A

Step 2. Look For Adjustments

The next step is to find whether the company has any non-recurring items or adjustments. Non-recurring items are basically items that do not occur on daily basis. For eg, excess salary paid to the owner. Any company won’t pay excess salary to any person working in the company every time. Unless there are some personal issues, the company might pay an excess salary. Similarly, a company won’t receive excess income from rent regularly. There is a 10% chance of this happening. We have also given a list of items that get included in Adjustments above, refer to that section.

Step 3. Deduct Adjustments From EBITDA

The last step is to calculate Adjusted EBITDA. You need to add or less the non-recurring items from EBITDA. For eg, if it is an expense, you need to add it to EBITDA. Similarly, if it is an income or gain from the sale of an asset, deduct/less from EBITDA. Finally, when you add or less the adjustments from EBITDA, basically you will get the value of Adjusted EBITDA.

Adjusted EBITDA Example

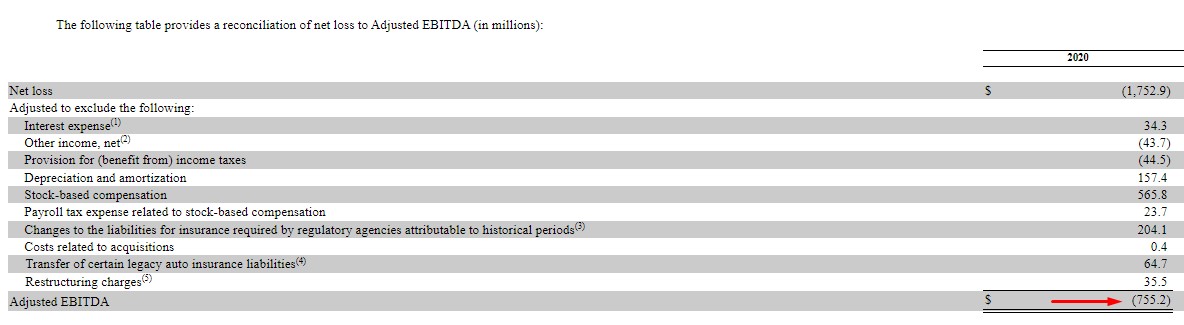

We have taken an example of an LYFT company. LYFT is an American company founded on June 9, 2012. This company basically hires vehicles, rents cars, also there is a bicycle sharing system for people. Also, they have an app through which they operate these services. Along with that, they also have a food delivery service. The following is the calculation of the Adjusted EBITDA of the LYFT company.

As you can see, LYFT company made a negative income in the year 2020. The Net loss of the company in 2020 was $1,752.9 million. The amount of interest expense and other income stood at $34.3 million and $43.7 million. In 2020, the benefit from taxes was $44.5 million. Here, they have directly calculated Adjusted EBITDA. Just like any company, even LYFT has some non-recurring items in the year 2020. Therefore, the company has also calculated Adjusted EBITDA for the year 2020.

Some of the adjustments of the company include payment of stocks, some tax expenses, some costs related to acquisitions, etc. If the company has gained any income, just add it and if there is some expense, just deduct it. Therefore, LYFT Adjusted EBITDA is a negative figure of $755.2 million. Likewise, if the Adj EBITDA is negative, it tells that the company has got huge loss in that year.

What Is The Importance Of Adjusted EBITDA?

There is various importance of adjusted EBITDA on the company, but, we will discuss a few of them. The first and the foremost importance of adjusted EBITDA is that it helps the company to revise the EBITDA they have calculated. For eg, some non-recurring items might get ignored while calculating EBITDA. Therefore, it is important to calculate Adjusted EBITDA. Adj EBITDA gives us a chance to do the adjustments in the EBITDA. The second importance of adjusted EBITDA is that it is used in the valuation of the stock. Basically, we use Adjusted EBITDA to find Enterprise value. Thus, do not ignore the adjustments of the EBITDA because this might affect the Enterprise value of the firm. For eg, if the industry provides us the multiple of 4 and Adjusted EBITDA is $528654. Therefore, the formula for calculating EBITDA through the exit multiple methods is;

Enterprise value = EBITDA * Multiple

= 528654*4

= $2114616

Difference Between Adjusted EBITDA, Net Income And Gross Profit

Now that you know about Adjusted EBITDA, let’s now understand the difference between Adjusted EBITDA, Net income, and Gross profit. You might be thinking, all are almost the same but why are they different. Well, even if, all three mean the company earnings, they are different in some or the other way. Let’s look at the difference between all three of them.

Adjusted EBITDA | Gross Profit | Net Income |

Basically when you add or deduct certain non-recurring items from EBITDA, you get Adjusted EBITDA. | Gross Profit is the income earned after deducting costs related to production. | Net income thus tells how much the company has earned after deducting all the costs. |

It includes all the costs basically direct and indirect. | It includes only production costs. | Net income also includes both direct and indirect costs. |

The formula for Adjusted EBITDA; Adjusted EBITDA = EBITDA ± Adjustments | The formula for Gross Profit; Gross Profit = Revenue – Cost of goods sold | The formula for Net Income; Net Income = Total revenue – Total expenses |

Pros And Cons Of Adjusted EBITDA

Now that we know about the importance of Adj EBITDA, let’s look at the Pros and Cons of Adjusted EBITDA. The following are the Pros and Cons of Adjusted EBITDA given below. Let’s check it out.

Pros

- Considers non-recurring items: The major drawback of EBITDA was that it used to ignore non-recurring items. But, Adjusted EBITDA considered them. Although these expenses occur only once, the impact of these expenses is huge.

- Helps in finding the cash flows: EBITDA tells the company how much they have earned this year. Basically, it determines the cash flows of the company.

- Mergers & acquisitions: Adjusted EBITDA is basically used when the company is used to merge with another company. Also, when you are going to buy another company, Adjusted EBITDA is calculated.

- Others: You can also predict the future earnings or cash flows of the company using EBITDA. Besides that, if a company has overvalued business then Adj EBITDA can be helpful. It will also help us to balance the valuation of a company.

Cons

- Not accepted everywhere: Adj EBITDA is a tool that investors use for analysis purposes. As per the rules of GAAP, you don’t need to calculate Adj EBITDA. Basically, it depends on the company if they wish to calculate it or not, since it is not necessary. Therefore, not all companies will be calculating it. Meanwhile, some companies might also show excess EBITDA.

- Different EBITDA: The Adj EBITDA will differ for different companies. The value of Adj EBITDA for a company in 2021 will be different than in the previous year.

Applications Of Adjusted EBITDA

Among all, there are some applications of Adj EBITDA in the industry. The first use is that whenever the company wants to do a merger, they can use Adj EBITDA. A merger is basically when two companies decide to join each other’s hands and work as one company. Similarly, the company can use Adj EBITDA for acquiring or buying other companies. Secondly, you can also use Adj EBITDA for calculating the enterprise value. Thus, Adj EBITDA also helps us to predict the future cash flows of a company.

Conclusion

From Adjusted EBITDA, the profitability of a firm can be determined. For calculating Adj EBITDA, you need to calculate EBITDA first. There are many non-recurring items included in the calculation of Adj EBITDA. This article discusses the method how calculating Adj EBITDA and the items included in the adjustments. Also, the importance of Adj EBITDA is discussed above. Besides that, how a company can use Adj EBITDA for making decisions in the company. We hope this article was useful to you for calculating Adj EBITDA. If you have any questions, you can comment down below.

FAQs

Yes it does. Basically, WeWork has created this new financial metric to measure profitability of their company. In community Adjusted EBITDA, WeWork considers tenant fees, rent expense, staffing expense, facilities management expense, etc. Indeed, the importance of community adjusted EBITDA is only for WeWork company. In 2018, when Wework brought this new metric in market, many companies were surprised. But, why was this created? Well, WeWork just wanted to show a good image about their Net income in their books. Therefore, they calculate community adjusted EBITDA.

Basically, Adjusted EBITDA and EBITDA are not a part of GAAP. Compared to other items, it is not necessary to calculate Adjusted EBITDA. However, most research analysts and investors differ on its calculation or usefulness. Besides that, companies like Apple Inc, Amazon did not calculate Adj EBITDA in their annual reports.