Introduction

There are many ways to calculate the FCF of a company. But, do you find it difficult to calculate FCF? Well, you’re on the right article. This article will guide you on how to calculate free cash flow, reasons why free cash flow can be negative, and the application of FCF in different fields.

Free cash flow or FCF can be one of the most useful metrics for private companies, especially for startups. You can manage your business when you know where your cash is coming from, but also where it is going and really make a difference in your management strategies. However, this can be difficult to calculate and is not always obvious. This article will break down the different steps to calculate free cash flow and help you understand this important metric. Let’s check it out.

What's Free Cash Flow?

Free Cash flow is the amount of cash available to pay the equity shareholders and the investors of the company. In other words, it is the money left with the company to pay the dividends to the owners and the shareholders. FCF is the cash left out after deducting the capital expenditures of the firm. The positive Free cash flow proves an indication of the company’s ability to pay money to the investors. But, sometimes, that’s not the case every time. The company might have negative FCF also which might indicate that the company is not having enough funds. Similarly, some companies might have negative free cash flow but we cannot say that the company doesn’t have enough money. It’s just as simple as the company is investing in its growth.

Formula For Calculating Free Cash Flow

FCF is the cash remaining after paying the expenses of the company. Basically, it is the excess money left out after paying all the bills, payouts, and taxes of the company. Now that you know the meaning of free cash flow, let’s look at the formula for calculating FCF. Although there are many ways to calculate FCF, there is one simple way for finding Free cash flow. The formula for calculating FCF is;

Free cash Flow = EBIAT (or NOPAT) + Net non operating expenses (D & A) – CapEx – Change in NWC

Here, NOPAT means Net Operating Profit After Tax, and CapEx means Capital Expenditure. Basically, CapEx is the money USD by the company to buy, repair or upgrade the assets of the company. You can easily find all these items in the financial statements of the company. But, you need to find the value of Change in net working capital. For that, you need to find the value of WC for two or more years and find the Change in NWC.

What Is Operating Cash Flow?

The name itself gives the meaning of the word. Operating cash flow means the money that’s left out after paying the expenses related to the day-to-day activities of the business. In other words, it is the excess money that is remaining after deducting expenses from the total revenue of the company. It is also known as Cash from operations. While preparing the cash flow statement, the OCF comes first followed by Cash from investing activities. OCF helps the company in determining whether it is doing financially well. Eventually, it also tells whether the company is earning more when it sells than it spends on producing. It also answers questions like should a company expand its business or not. Similarly, there are many decisions taken from operating cash flow.

Formula Of Operating Cash Flow

Operating Cash flow acts as a sound metric for the company. Now that you know about operating cash flow, let’s look at the two methods that get used to calculate operating cash flow. There are two methods; the Direct Method and the Indirect Method. Although there are two methods, many companies prefer the second method i.e Indirect Method. The following are the methods for calculating operating cash flow.

Direct Method

Many small businesses adopt this method. In the Direct method, the company also tries to deduct cash payments from cash receipts. But, if we look at the indirect method, items such as non-cash expenses get deducted, but here, there is no such effect. The GAAP insists that companies should also use the Indirect method rather than the direct method. The formula for the direct method is;

Operating Cash Flow = Total Revenue – Operating Expenses

Indirect Method

The most used method is the Indirect Method. As per GAAP, many companies need to calculate operating cash flow as per the Indirect method. Besides that, this method gives the correct value for the operating cash flow. You can easily find the values in the annual report. This method takes into account different expenses that get ignored in the direct method of OCF. The formula for calculating through the Indirect method is;

Operating Cash flow = Net income ± changes in assets and liabilities + Non-cash expenses

Types Of FCF

Free cash flow indicates the financial ability of the company to share its money among the owners of the company. There are many questions about whether free cash flow is the same as net income. But, both are different. Net income tells how much money the company has over a certain point of time. Sometimes the company might earn an income that they will receive next year. Thus, that would be still considered as income. But, free cash flow has many calculations, and therefore, it is precise. Now that you know about Free cash flow, let’s look at the different types of FCF.

FCFF

FCFF or Free cash flow available to the firm indicates the amount of money available with the firm after paying different expenses like depreciation and investment costs. In simple words, it is the cash left with the firm rather than the equity holders. It is an important tool in the DCF model. Thus, a positive FCFF indicates that the firm has enough money remaining after paying all the expenses. On the contrary, the negative FCFF indicates that the firm has nothing left and can indicate the company’s liquidity. The formula to calculate the FCFF is;

FCFF = NOPAT + Dep & Amor – CapEx – Change in NWC

FCFE

FCFE or Free Cash flow to equity is the cash left out for paying money to the investors and shareholders. Levered cash flow is another name for FCFE. In other words, FCFE is the money left after paying all the expenses of the company. Along with that, the remaining money company uses to pay dividends. Likewise, the company can also use the cash to do a share buyback process. The share buyback is basically a process where a company will itself buy its shares. There are many reasons for doing share buyback, one of them includes having excess cash but not many projects to invest in. In such a case, the company will do a stock buyback. The formula for FCFE is;

FCFE = FCFF + Net borrowings – Interest amount *(1- tax rate)

How To Calculate The Free Cash Flow?

Now that, you know about the different types of FCF, let’s understand how to calculate free cash flow to the firm. The following are the steps for calculating FCF. Let’s check it out.

- Calculate Change in NWC: The first and the foremost step includes calculating the change in net working capital (NWC). For that, you need to first calculate working capital for two or more years. And, then find the change between NWC of two years.

- Find NOPAT: The next step involves finding NOPAT. For calculating them, you need to first calculate EBIT. To find EBIT, deduct D&A from EBITDA. Thus, to find NOPAT, use the formula;

NOPAT = EBIT*(1-ETR)

3. Calculate Non-Operating expenses: Non-operating expenses are basically Depreciation and Amortization (D&A) expenses of the firm.

4. Find Free cash flow: Lastly, you need to assemble all the calculated items in the formula. The formula for calculating FCF is;

FCF = NOPAT + Dep & Amor – CapEx – Change in NWC

Free Cash Flow Examples

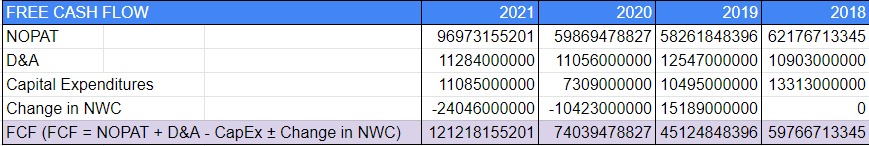

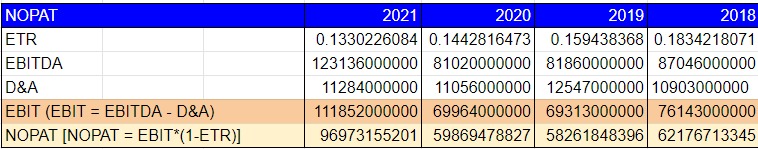

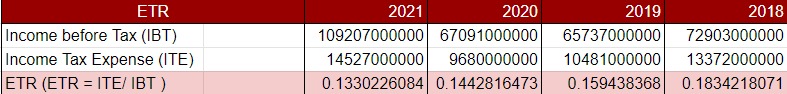

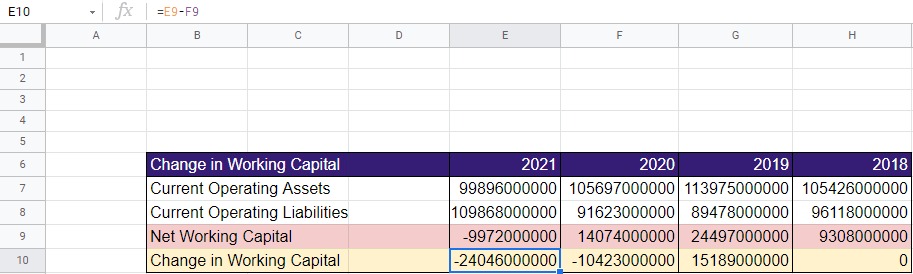

Here is an example of the Free cash flow of Apple Inc in excel. The data we have taken is from Investing guru. The following are the calculation of FCF in Google Sheets. Let’s have a look.

Step 1: The first step involves calculating the ETR of the company. Because you will need it for calculating NOPAT. The Slide 3 involves the calculation of ETR. The formula for ETR is; ETR = Income tax expense / Income before tax

Step 2: Now, you need to calculate Change in working capital for the firm. Slide 4 involves the calculation of Change in working capital.

Step 3: The next step involves the calculation of NOPAT. You can see the working of NOPAT in the first slide.

Step 4: Lastly, you need to assemble all the above values, and put them in the formula. Sometimes, the Change in working capital can be negative. Thus, if the value of Change in NWC is negative, you need to calculate with the minus sign, do not ignore it. The value of FCF for the year 2021 is $121,21,81,55,201.

Why Is FCF Important?

There are many reasons why many companies use FCF for making decisions. Sometimes there can be negative free cash flow and tell a lot about the company. Now that you’re familiar with how to calculate the FCF of the company, let’s understand the importance of FCF in the decision-making process of a company. Many analysts, investors, and creditors might use FCF to find out whether the company has been valued more or has been valued more. Let’s check it out.

Investors

Investors are the sole owners of the company. It is their money that the company is using to run the company. It is their right to see that the company is using their money in the right way. But, what if it happens in the opposite way? Well, the investors will withdraw their money back. And no company will ever want that to happen. Investors and analysts always want some kind of return from the money they have invested. For that, investors calculate FCF. Basically, FCF tells them how much money is remaining with the company. Also, for what purpose they are using this money. There can be many reasons like, the company can use this money and invest it in their projects. In that case, it will yield returns for the company. Similarly, the company can also use the money to give dividends to the shareholders.

Creditors And Analysts

Businesses need a certain amount of extra money to keep risks at bay and FCF helps in that case. For eg, consider you want to take a debt of $5000 this year for some purpose. How will the person or creditor give you credit? If it was a personal loan, they would look at your credit score. But, here the creditor will look at your FCF. Why, because FCF will tell the creditor how much money the company has after paying all the expenses. The creditor wants to assure himself that the company has enough money to pay back the debt money. FCF also acts as a metric for sanctioning the loan for the company. For analysts, FCF helps them to say whether the company’s value is high or low. Thus, if the company’s value is more than its price, they might recommend investing in it and vice versa.

Can Free Cash Flow Be Negative?

You might be thinking, can free cash flow be negative? And, if it is so should we consider the company poor? Well, keep on reading further. Yes, a company’s FCF can be negative as well as positive. If you calculate free cash flow, and it comes out to be positive, it shows a clear sign that the company has enough money to pay to the investors. But, what if the free cash flow is negative? Then, there are two possibilities for this outcome. The first says that the company might be seriously facing some cash crunches this year. Whereas, if we look at the other side, it says that the company might be having less money but the company is for a good purpose. In other words, the company might have spent on the growth of the company. Thus, money invested in growth will yield good returns in the future.

Basically, many growth companies or startups are doing this. Because they have innovative ideas and projects to work on. So, they try to invest in the up-gradation of the projects and machines so that they can earn more in the future.

Application Of Free Cash Flow

Analysts use Free cash flow for various purposes. The first application is that you can use FCF to find whether the company gets valued more than its price or less. To find that, you need to calculate something called the “Price free cash flow ratio (PFCF)”. this ratio helps us to find whether the stocks of a company are overvalued or undervalued. If the value is higher, it means that the stocks are overvalued in comparison to FCF. On the other hand, if the value is low, it indicates that the free cash flows are higher than the market cap of the company. The other application of FCF is in the discount-free cash flow model. In the DCF model, it is an important tool in forecasting the future item values of the company. Thus, FCF proves to be a vital metric for taking decisions in the company.

Conclusion

Free cash flow is the cash flow left over after all expenditures have been paid and are usually expressed as a negative number. It is also referred to as cash flow from operations since it is one of two primary financial statements that contain information about cash flow for a company. This article discusses how to calculate free cash flow for a business. Also, as to whether free cash can be negative or not, as well as the application of FCF in the various decision-making processes. We hope, this article has made it easy for you to calculate the FCF of a company. If you have any questions, comment down below.