Introduction

Finding terminal value is an important element of the DCF model. But, many analysts find it difficult to find the terminal value. Well, we have made it easy for you. This article will guide you through the 5 easy steps of terminal value calculation, along with that we have also given an example of terminal value, various pros and cons, and lastly, application of terminal value. Let’s check it out.

What Does Terminal Value Mean?

Terminal value basically estimates/predicts the value of the company beyond the forecasted future cash flows. In simple words, you are finding the cash flows for the next few years and based on some growth rate, you will find the terminal value.

However, when forecasting the future cash flows, forecast only for a minimum of 5 to 10 years. Because if you predict for very long years, the results might be inaccurate(not correct). Besides that, the Terminal value is also used in the DCF model. It forms an important element of the DCF model.

Formula Of Terminal Value

Now that you know about the terminal value, let’s look at the formula of terminal value. Although they are two Terminal value calculation formula, you can use any of them. One formula is of Perpetuity method and the other is of Exit Multiple methods. The following are the terminal value calculation formulas. Let’s check it out.

- The formula of the Perpetuity method is;

Terminal Value = [FCF x (1 +g)]/ WACC – g

Here, FCF – “Future cash flows” in the final year

g – Long-term growth rate (Inflation)

WACC – Weighted average cost of capital

Or

2. The formula of Exit Multiple Method is;

Terminal Value = Any Financial metric (EBITDA, EBIT) x Trading Multiple

Here, Financial metric – Usually EBITDA, EBIT, or Sales

Trading Multiple – Usually in (x times). For eg, EBITDA multiple: 10x times

Methods For Calculating The Terminal Value

Basically for calculating the terminal value, there are two methods. In terminal value, perpetuity method and exit multiple are the two methods widely used. The following are the two methods used in terminal value valuation. Let’s check it out.

Perpetuity Method

Perpetuity basically means that the flow of cash is infinite. In finance, Perpetuity means that there is a constant flow of cash through the end of the period. The Perpetuity method is also called as “Gordon Growth Model“. This model is basically named after Myron Gordan. He was an economist at the University of Toronto. Thus, he worked on a formula in the late 1950s. Using Perpetuity, terminal value can be calculated. In terminal value calculation, formula through the Perpetuity method is,

Terminal value = [FCF x (1 + g)] / (WACC – g)

Here, FCF means “Final Projected cash flow“. G means the “Long-term growth rate” of the company. The rate at which the company is bound to grow. A terminal growth rate is usually based on the long inflation rate. But it is not higher than the historical GDP growth rate. WACC is the Weighted Average Cost of Capital. You will have to calculate WACC for the company.

Exit Multiple Model

This is another way of calculating the terminal value of a company or an investment. It assumes that the life of the asset is finite. This method is often used when a company is getting acquired by another firm. The formula for calculating terminal value through the Exit multiple methods is;

TV = Financial metric (EBITDA or other) ✕ trading multiple

The formula basically multiples the financial metric to a trading multiple. Now, financial items can be any major item from the financial statements like EBITDA, EBIT, Sales, etc. Whereas, the Trading multiple is an “Average of the recent exit multiples of similar companies“. But, what is Exit multiple? Exit multiple can be any major item or ratio. For eg; EV/EBITDA, EV/EBIT, EV/Sales, P/E ratios, etc. In the next section of the article, we will see an example of how to find the terminal value.

How To Find The Terminal Value?

Now that you know about the terminal value methods, let’s understand how to find the terminal value. Although there are two methods, we have given some simple easy steps for calculating the terminal value through both the methods. Let’s check it out.

Calculation Through The Perpetuity Method

Here are the 5 easy steps on how to compute the terminal value of a company.

1. Calculate the FCFF: The first step is to calculate the Free cash flow of the company. The formula for

calculating FCFF is;

FCFF = EBITDA – D&A – Capital Expenditure – Change in net working capital

2. Find the value of WACC: The next step is to calculate the WACC. The formula for calculating WACC is;

WACC = We x Ke + Wd x Kd

3. Calculate LTGR and 5YGR: For terminal value, certain growth rate you need to calculate. One is the Long-term growth(Inflation) rate and 5YGR. You need to assign certain weights to find the growth rates. Weights are like 1,2,3,4 based on the company’s performance. For eg, if a company did well in 2018, you will assign 4 or 3. Likewise, if it did worse in 2020, you will assign 1. So, you will find the average growth rates for 10 years. In the example of terminal value calculation, formula for calculating weights is given below.

4. Calculate the future cash flows: After calculating WACC, calculate the future cash flows. Basically, here you try to forecast the cash flows for the next 5 years. The formula for calculating future cash flows is;

Future cash flows (Year1) = Current year FCFF x (1 + 5Yr growth rate)

Future cash flows (Year2) = Future cash flows (Year 1) x (1 + 5Yr growth rate)

5. Find the Terminal value: Lastly, calculate the terminal value of a company. You will take last year’s future cash flow and calculate terminal value. The formula of the terminal value is;

Terminal value = FCF (last projected year) x (1 + LTGR)

WACC – LTGR

Calculation Through Exit Multiple Method

Here are the 2 easy steps on how to compute the terminal value of a company.

1. Calculate the Exit and Trading Multiple: The first step is to calculate an Exit multiple. An Exit multiple can be EV/EBITDA, EV/EBIT, P/E ratios. Find the Exit multiple of similar companies and then take the average of it. The average you will get is the trading multiple of the industry. Trading multiple basically tells the common rate the companies are working in that sector. For example, if the trading multiple of EV/EBITDA is 12x, it means other companies are having trading multiple as 12x, so even your company should have the same.

2. Find the Terminal value: Now that you have calculated the trading multiple, you can easily find the terminal value of the company. Note that, if you are taking EV/EBITDA as your exit multiple, then you should only take EBITDA as your financial metric. The formula for calculating terminal value is;

Terminal value = Financial metric (EBIT, EBT, Sales) x Trading multiple (eg, 10x)

Example Of Terminal Value

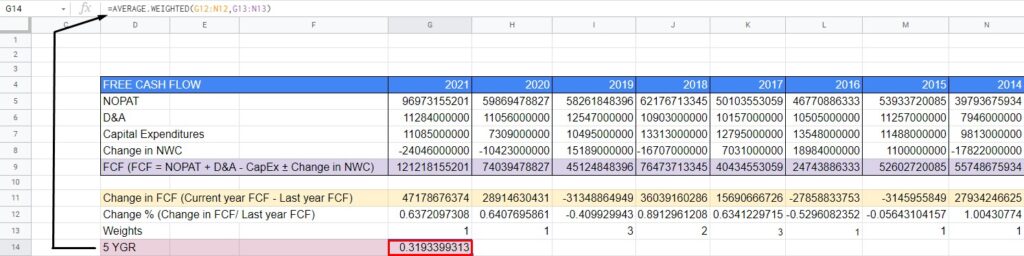

There is an example of terminal value of Apple INC. The business strategy of Apple is successful in itself. This excel sheet contains the calculation of the terminal value. This data is basically taken from Investing guru. Well, you can see the calculation of Free cash flow to the firm. Here is the calculation of the terminal value.

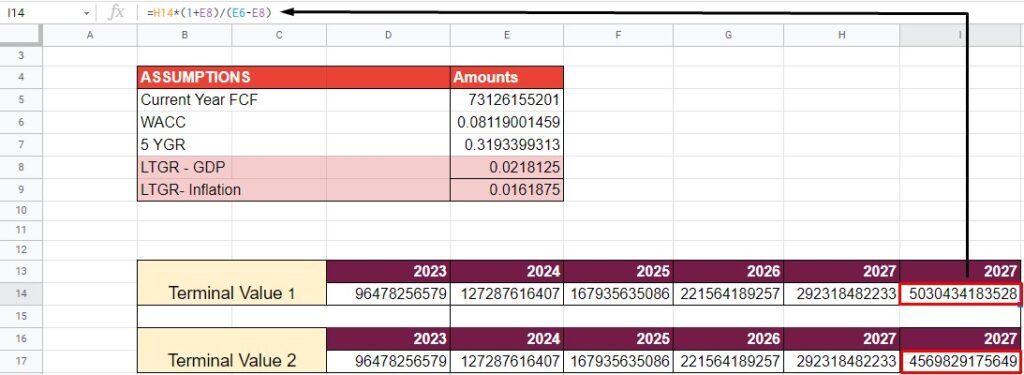

Step 1: We have calculated 5YGR in slide 2. For that find the change in FCF, and Change %, then assign some weights. Thus, the 5YGR is 0.3193399313.

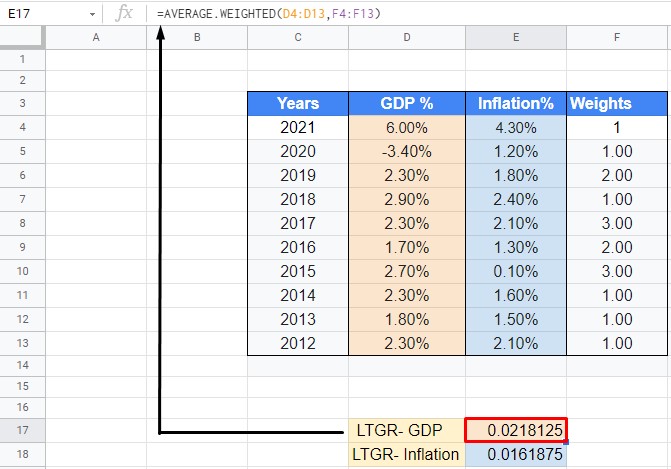

Step 2: In slide 3, the calculation for LTGR. But before that, you need to search for the long-term growth rate of your country for the past 10 years. And then assign some weights based on the company’s performance. Eventually, use the excel function, [=Average.Weighted(GDP% cells, weights cells)]. In the above example of terminal value, the LTGR of Inflation is 0.0218125. Likewise, LTGR can be of Inflation as well as GDP.

Step 3: In slide 1, we have calculated the free cash flows for the next five years using the formula. The FCF in the year 2027 is $292,318,482,233.

Step 4: We have calculated Terminal value using both LTGR(GDP and Inflation). The terminal value using LTGR(GDP) is $5030,434,183,528. While, the other terminal value is $45,69,829,175,649.

How To Find The Present Value Of The Terminal Value

Now that you know about terminal value, let’s see how to find the present value of the terminal value. Basically, the present value is the current value of the investment and the terminal value is the future value of the investment. For the present value of terminal value calculation, formula is,

Present value= Terminal value / (1 + k)^n

Or

Present value = Terminal value/ WACC

Here, k is the cost of the capital or the investment. Let’s assume the number of years is 5. And, the WACC is 20%. Terminal value is $7500. So, by using the formula for net present value, the present value is $37,500.

Benefits And Limitations Of Finding TV

You might be wondering whether finding the terminal value of the company can be beneficial to the company or not? Well, there are some plus points for calculating the terminal value. Also, there are limitations to the process also. Here are some Pros and cons of finding the terminal value.

Benefits of Finding Terminal Value

There are some advantages of finding the terminal value. They are as follows.

1. Informs Business Decisions: Every company needs to find the terminal value of its business or any project. It will help you to predict the risk and assess the business decisions. With the terminal value, you can also find the future value of what effect one decision might have on the business.

2. Shows the Investment value: Finding the terminal value allows us to know the value of the investment. You need to choose such investments that will earn good returns for you. The terminal value will help you with that. It will help you to choose between good and bad investments, investments that will earn more, etc. Thus, it will act as a tool for investors who wish to invest.

3. Uses The Present Value to find the Terminal value: The process of finding the terminal value involves using the present value. Throughout the process, if you want to find the TV, you need to use the current value of the investment. In the business, the trends keep on changing. Therefore, it is necessary you use the present value. This will give you an accurate value of the investment.

Limitations of the TV

Like every coin has two sides, even this method also has some limitations. Here are some Cons of finding the terminal value. They are as follows.

1. Predictions Are Not Always True: Predictions of terminal value are not always true. In this world, no one could ever give accurate predictions. Even the weather forecast could go wrong at times. While finding the terminal value, you can make some assumptions. But, to be practical, who knows what event might occur and disturb the cash flows. You should only consider this method as a guide, not as a full-proof tool.

2. Multiples might change: In the exit multiple methods, multiples get used. The multiples that the companies use change often. Thus this method can be a bit challenging at times. Regular research methods can help you track how multiples change over time. It allows you to determine them more accurately.

Application Of Terminal Value

The terminal value plays an important role in the DCF valuation. In other words, DCF and terminal value are related. In the DCF, terminal value calculation helps to find the enterprise value. For calculating terminal value in DCF, the procedure remains the same. Just like you calculated terminal value through the perpetuity method. Even the terminal value calculation formula in DCF remains the same. From the above example of terminal value, you can easily calculate the terminal value in DCF. Terminal value plays an important role in business decisions. It also helps the company during mergers and acquisitions. Also, it can be helpful for those who invest as well. Therefore, while you use terminal value it is important that you do analysis as well.

Conclusion

The terminal value is a simple concept but something that a lot of investors struggle with. Thus you can use it to work out how much a business is worth today and how much it might be worth in the future. This article summarizes the process of how to find the terminal value. Also, it discusses the terminal value calculation formula. Besides that, we have also given an example of a terminal value. We hope this article solves all your queries If you have any questions, you can comment down below.

FAQs

Well, there is a ready straight answer. Many companies start so that they develop their brand for a longer period. They do not assume that their business will stop in a few years. They work thinking that the company will grow for many years. Therefore, assuming that the company will grow in the future, terminal value is calculated.

Yes, the terminal value can be negative as well as positive. If the value is negative, it tells that the future cash outflow is exceeding the growth rate. In other words, the money that you invested is more than the money you will earn back. If you as an investor come across negative earnings, then you should also look at the other factors. This will help you find the best investment or best company to invest in.