Introduction

Sinopec company profile shows a good picture of the company but the reality is something different. Similarly, do you know, why the stock prices of Sinopec Corp are giving negative returns for the past few years? Well, you’re on the right path. This article will guide you through the Sinopec group annual report and analysis of its financial statements, dividend history for the past few years, and lastly, whether you should buy Sinopec stock or not.

Sinopec is the largest company in China. They have a huge presence in oil and gas in China, but they also have a wide range of other operations. Sinopec has thousands of projects in China, and they are looking to expand even further. In this article, you will get a comprehensive look at Sinopec and what they have been up to recently. You’ll learn their strengths and weaknesses. You’ll also see their recent deals and partnerships with other companies. Last year was a big one for Sinopec, so this will be a big blog.

Brief About Sinopec Company Profile

Sinopec Group is the world’s largest oil refining and gas company. The company was established in July 1998. The company has many subsidiaries, out of which major one still remains Sinopec Limited. Are they both the same? Well, Sinopec Group is the parent company whereas Sinopec Limited is a subsidiary of it. Sinopec Group is a state-owned company. Therefore, almost all the shares are owned by the government. This makes the government owner of Sinopec Group. Also, the investor rights over its subsidiaries are performed by the Sinopec Group. Besides that, when the company wanted to list on the overseas Stock exchanges, it appointed Sinopec Ltd to do so. Thus, Sinopec Ltd was listed on the stock exchange in August 2001.

As per the Sinopec group annual report, the total revenue recorded in the financial statements in the year 2021 was $283,727.6. According to Fortune Global 500, Sinopec Group bagged 5th rank whereas 4th rank went to CNPC. Looking at Sinopec company profile, there are more than 384,065 employees. Currently, Sinopec group has more than 32 subsidiaries.

History Of Sinopec Group

Although listing took place in 2001, the history goes way back to 1998. The Ministry felt a need for some power that will look over the activities of petroleum supply in the country. Thus, China Petrochemical corporation got established in the year 1998. Soon, the company started blooming. The company listed its subsidiary Sinopec Ltd on the NSE, London, and HKEX in 2000. At that time, the company issued 16.78 billion H-shares and 2.8 billion A-shares. Likewise, on August 18, 2001, Sinopec Group was listed on the Shanghai Exchange. In the same month, the company acquired the assets of Sinopec Star Petroleum. Thus, from the period 2002 to 2009, there are more than 9 purchases of the companies. In March 2010, Sinopec group acquired 50% interest in Block 18 in Angola.

Eventually, in February 2011, the company issued $23 billion A-share convertible bonds. In February 2013, they completed the process of placing $2.8 billion in new H-shares. Sinopec Group took projects in the regions of CIR (Kazakhstan), UDM (Russia), and Mansarovar (Colombia). Thus, in 2018, Sinopec group invested RMB 4.9 billion in a newly formed company called Sinopec Capital Co. Ltd with a capital of RMB 10 billion. Recently, the company sold assets related to oil and gas pipelines to China Oil & Gas Piping Network Corp. In the 2021 Forbes Global 2000, Sinopec was ranked as the 48th largest public company in the world.

Sinopec Group Annual Report

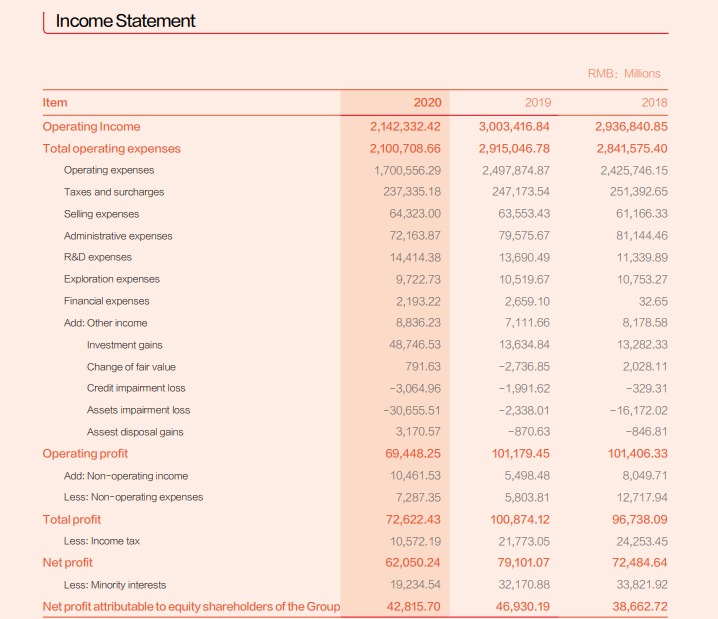

Here, are the Sinopec financial statements as per the annual reports 2020. The financial statements include the Income statements and Balance sheets. Let’s have a look over it.

As per the Sinopec group annual report, the operating income in 2020 was $339131.22 million (All amounts are converted from RMB to USD). The company is also involved in R&D, thus, the R&D expenses come to $2281.80 million. Whereas in 2019, it was $2167.20 million. In 2020, the taxes sum up to $37570.16 million. While in 2019, the figure was around $39127.57 million. There was a slight decrease in the tax rate. Likewise, in 2020, the company gained $7716.58 million from investments. Whereas in 2019, the value was much lower, aiming at $2158.40 million. The operating profit in 2020, was $10993.66 million. Whereas in 2019, it was $16016.71 million. Thus, the net profit at the end of 2020, was $9822.55 million while in 2019, it was $12521.70 million. Finally, the EBIT or profit available to equity holders in 2020, was $6777.73 million, slightly lower than 2019.

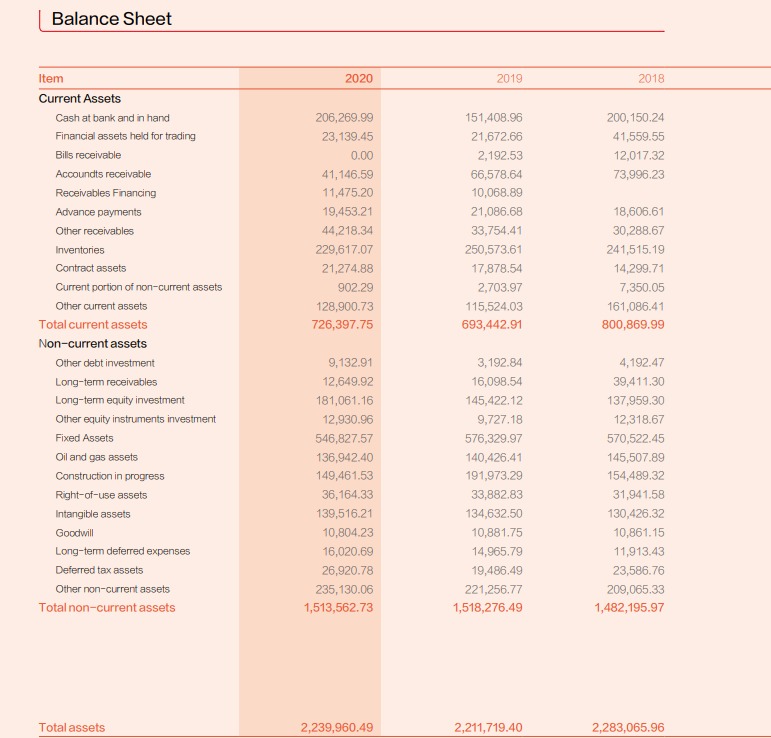

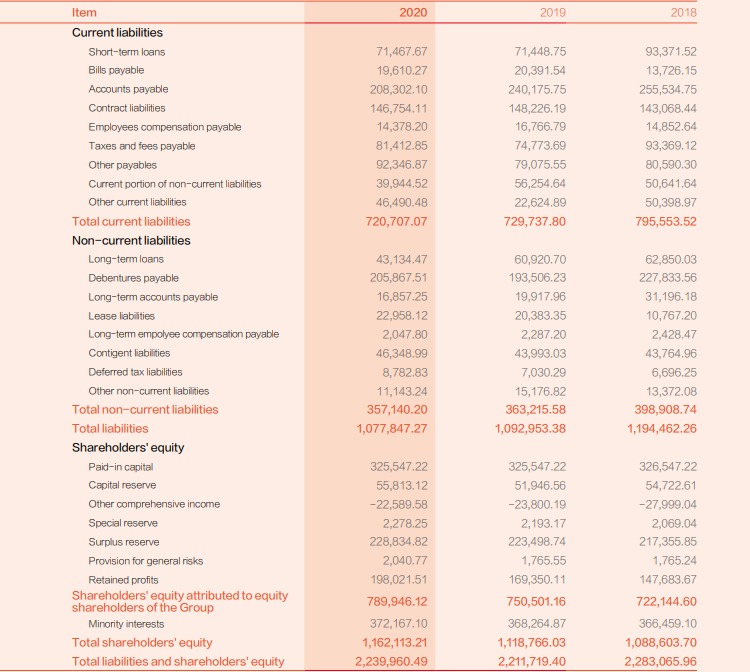

While comparing the Sinopec financial statements, the balance sheet items did not do well in 2020. The Cash available with the company in 2020 was $32652.54 million while in 2019, it was $23968.04 million. The total current assets with the company were $114988.76 million whereas, in 2019, there was $109772.01 million worth of assets. In 2020, there were $354585.75 million in total assets. While the total liabilities were $170623.22 million in 2020.

Analysis Of Sinopec Financial Statements

Now that you know about the Sinopec company’s profile and Sinopec group annual report, let’s look over the analysis part of the financial statements. Looking at the report, there was one factor that had affected the company’s operations. And, that was the Covid 19 crisis. Just like all companies were doing pretty low in terms of revenue even Sinopec was one of them. Some major items of the balance sheet saw some major changes. As per the balance sheet, the cash in hand was more than 2019. There was a 36.23% increase as compared to 2019. This was because, in 2020, many companies had shut down. Besides that, the company’s production has also stopped in the same year. Therefore, there was an increase of 4.75% in the total current assets. Whereas the total liabilities saw a 1.3% decrease in 2020.

While talking about the Income statement, the operating income also saw a decrease of 28.7% recorded in 2020. Also, the investment gains of the company increased in 2020 than 2019. There was an increase of 257.515% as compared to 2019. This was because the company had invested in Carbon neutrality projects in 2020. Likewise, because of less income, the income tax saw a decrease of 51.4% in 2020 as compared to 2019.

History Of Sinopec Group Share Price

Now that you know about the Sinopec group annual report, let’s understand the price history of the company. In order to enter the market, the company launched Sinopec Corp as a listing company. The company entered the exchange in October 2000. The Ticker of the company on the exchange was SNP. The share price of the company at that time was $15.24. The prices started seeing an upward trend in the stocks. On December 31, 2003, the stock price of SNP was $34.16. Again, the company saw a shoot in the stock prices. Therefore, on October 31, 2007, the stock price was $127.62. It was an all-time high till now. But, history had to repeat again. As usual, the prices saw a downfall. The prices kept falling after October 2007. This resulted in the prices on March 30, 2008 dropping to $66.14.

On February 27, 2009, the prices dropped to $40.35. Thus, after that, the market started recovering. Basically, in the past 5 years, there have been negative returns of -26.22%. The market has also been seeing various variations in the prices. The prices are constantly falling down. Even before 2020, the prices were falling. Thus, it indicates that the Covid 19 was not the only factor for low stock prices. On October 15, 2020, the price was $38.83, which was even lower than the listing price at the start. Even when the Sinopec group released its annual report for 2020 on March 31, 2021, the price just moved a bit but the prices again fell down. As of February 22, 2022, the current stock price is $51.94. This movement of Sinopec prices will also determine the dividend for the shareholders.

Interpretation Of Share Prices

The stock prices of Sinopec Corp were doing pretty good in the starting years of the business. In August 2003, the prices saw an upward trend in the stock market. They were heading upward towards the hilltop. The stock price reached an all-time high of $127.62 on October 30, 2007. After this, the company saw many small highs and lows in the prices. Again in August 2018, the price reached $100.44. This was the highest in recent years. However, the market in the past few years is a little bit down. In the past year, there was a decrease of 6.05% in returns on the stocks.

While comparing the last few months, the prices are recovering from the downward trend. But, if we talk about the stock in the past few days, it is not doing well. Thus, this is the right time to buy the stock because the prices soon witness an upward trend.

History Of Sinopec Dividend Over Few Years

Just like the stocks even the Sinopec Corp dividend has been recorded low. The final dividend as of March 2002, for year 2001 was RMB 0.0800. Thereafter, the Sinopec dividend for both the years (2002 & 2003) was RMB 0.0600. The dividend for the year 2004 was RMB 0.0800. While the interim dividend for 2004,2005,2006 was 0.0400. The final dividend for the year 2007 was RMB 0.1150. The highest Sinopec dividend ever recorded was RMB 0.2000 for the year 2012. To be clear, the company has given all the dividends in cash. But, after 2013, for some years Sinopec Corp stopped paying interim dividends.

To date, there haven’t been any dividends for the first, second, and third quarters. This is because the company is facing losses in the past few years. They are not capable of making payments for dividends for the quarters. But, in August 2020, Sinopec announced a special dividend. Thus, they are only paying the final and some interim dividends to date.

Subsidiaries Of Sinopec

As per the Sinopec company profile, the company has many subsidiaries. In other words, Sinopec Group just owns Sinopec Corp. But Sinopec Corp owns many companies today. There are many fields in which they operate. The following is the list of the companies Sinopec Corp owns.

SINOPEC Engineering Group Co Ltd

Sinopec engineering company is majorly involved in the construction of roads, buildings. Besides that, the company also takes on projects on building large oil plants in the company. The company was formed in 1953 in China. Currently, there are more than 2,100 people working in the company. The market cap of the company currently is £1.57bn.

Sinopec Corp

In February 2000, Sinopec Group created Sinopec Ltd. Sinopec Corp is a joint-stock company. On behalf of the Sinopec group, it got listed on NYSE, London exchanges. As per the Sinopec annual report, the total operating income in financial statements of 2020 is 5,033.10cr.

Sinopec Shanghai Petrochemical Co Ltd

Sinopec Shanghai Petrochemical Co Ltd is another subsidiary of Sinopec Group. This company processes crude oil into synthetic fibers, resins and plastics, intermediate petrochemicals, and petroleum products. It was founded in 1972. Also, it is a state-owned enterprise. The total revenue of the company stands at $61,560.9 million whereas the market cap stands at $5.44B. However, the company’s financials are doing so well.

Others

In total, there are more than 32 subsidiaries and research centers of Sinopec Corp. Since Sinopec Group owns Sinopec Corp, the acquisitions of Sinopec are also a part of Sinopec Group. Until now, the company has brought many companies in the oilfield sector, petroleum, and many other sectors.

Top Competitors Of Sinopec Group

Competition forces us to improve better. Just like every company has many rivals, even Sinopec company profile has some of them. Being one of the largest oil companies in China, the company has rivals to face too. The biggest competition is from CNPC (PetroChina). The total revenue of Petrochina stands at $19,33,836.0 million whereas that of Sinopec Corp stands at $21,05,984.0 million. The market cap of Sinopec Corp stands at $79.65 billion and that of Petrochina is $159.54B. It is clearly seen that in terms of market cap, Petrochina exceeds Sinopec Corp. Another rival of the Sinopec group is CNOOC. The company is also engaged in the production of oil and gas. The total revenue of CNOOC as per the latest annual report is $108 Billion. There are more than 18,103 people working there. The company has more than 45 subsidiaries and the market cap stands at 45.45TCr.

Should You Buy Sinopec Stock?

Now that we have analyzed the financials of the Sinopec company profile, let’s understand whether it is worth buying Sinopec stock or not. Well, the company’s financials in 2020 have performed low as compared to 2019. Even the stock prices of Sinopec are doing pretty low in recent months, also the dividends for the quarters have also stopped. China Petroleum & Chemical pays out 50.0% of its earnings in the form of a dividend. But, there are some positive pros to this also. The tax rate in 2020 as per the Sinopec group annual report, has been reduced.

Again, the only factor that can make the trend go upward is the annual report of 2021 which will get released in March 2022. If the annual results are positive, then there are chances for the market to go up. As per the analysts, this is a good time to buy the stocks, if you’re keeping a mindset of holding them for a long-term period.

Conclusion

Sinopec Group is one of China’s largest oil and gas companies. It was formerly China Petroleum & Chemical Corporation (SNP) until a name change in January 2007. As of now, Sinopec Group has over 280,000 employees and a market capitalization of over US$200 billion. In 2011, the company produced 60 million tons of oil and 220 billion cubic meters of natural gas. Thus, this has made the Sinopec company profile perform well. But, in the last few years, the stock prices aren’t doing well. In this article, we have tried to give an analysis of the Sinopec Group annual report and financial statements. Also, a brief explanation on whether you should buy Sinopec stock or not. We hope, this article was useful to you. If you have any questions regarding the company, comment down below.