Introduction

You all might have heard about Volkswagen cars like Porsche, Lamborgini, and Audi. But, do you know the success story of Volkswagen? How much are the Volkswagen sales revenues in 2021? Well, this article will answer all your questions. This article will guide you through the detailed financial analysis of Volkswagen annual reports, the different subsidiaries of the company, Volkswagen stock price history, and lastly, whether Volkswagen is a good stock to buy or not. Let’s check it out.

Brief About Volkswagen

Volkswagen is a German-based automobile company that manufactures cars. In the name, “Volks” means People and Wagen means a Car which is a union means People’s car. The majority of the market is based in China with sales of 40%. German Labour Front founded Volkswagen Group in 1937. They have their headquarters in Wolfsburg, Germany. The first car they launched was Bettle. In 1990, Volkswagen revenues were $34,800.

Eventually, they increased the production of cars in the later years. Now, they deal in many cars such as Audi, Cupra, Lamborghini, Porsche, SEAT, Škoda, and Volkswagen brands. Besides that, they also sell motorcycles under the brand name Ducati, which is a subsidiary of Volkswagen. The company has operations in more than 100 locations in 27 countries. There are 665,445 employees working in the Volkswagen company.

According to Fortune Global 500, Volkswagen bagged the 10th rank, whereas Toyota got the 9th rank. Recently, they launched the “I.D Buzz” car model which will be on the market by the third quarter of 2022.

History & Success Of Volkswagen

Now that you know briefly about Volkswagen, let’s drive deep into the history of Volkswagen. As you read above, the German Labour Front founded the Volkswagen group in Berlin in the year 1937. Adolf Hitler was the dictator of Germany at that time. He fully supported the Volkswagen plant. Likewise, in the start, they used to manufacture military vehicles for the country. They also manufactured a V-1 flying Bomb during World war 2.

However, after the end of the war, the British army took the control of the plant. Volkswagen then used to make vehicles for the British army. Offers were made to British manufacturers to acquire Volkswagen but no one took interest. There were times when the plant was going to get demolished or closed. Later on, the British army handed back the plant to Germany.

In 1965, Volkswagen Group acquired Auto Union, which later created a new company with NSU Motorenwerke AG that came to be known as “Audi AG” in 1985.

Likewise in 1982, Volkswagen came into its first overseas agreement with Spanish car manufacturer “SEAT”. Later, acquired a 100% stake in the SEAT company. In 1998, Volkswagen acquired more three companies namely Bentley, Lamborgini, and Bugatti.

In 1991, Skoda automobiles and Volkswagen entered into a joint-venture agreement. Eventually, in 2000, it had a 100% stake in Skoda.

In 2009, Volkswagen took a 49.9% stake in Dr. Ing. h.c. F. Porsche Ag later acquired the whole control over the company.

Financial Analysis On Volkswagen Annual Reports

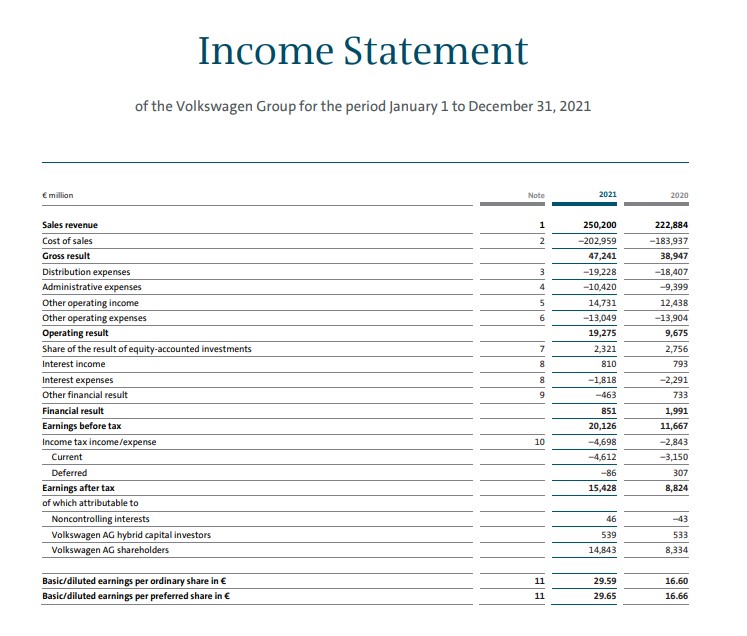

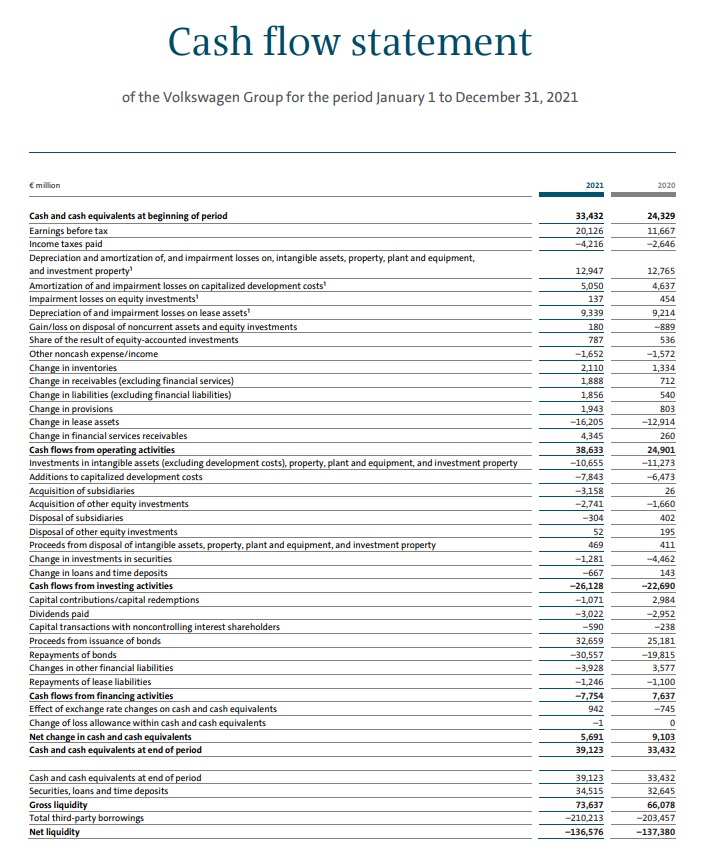

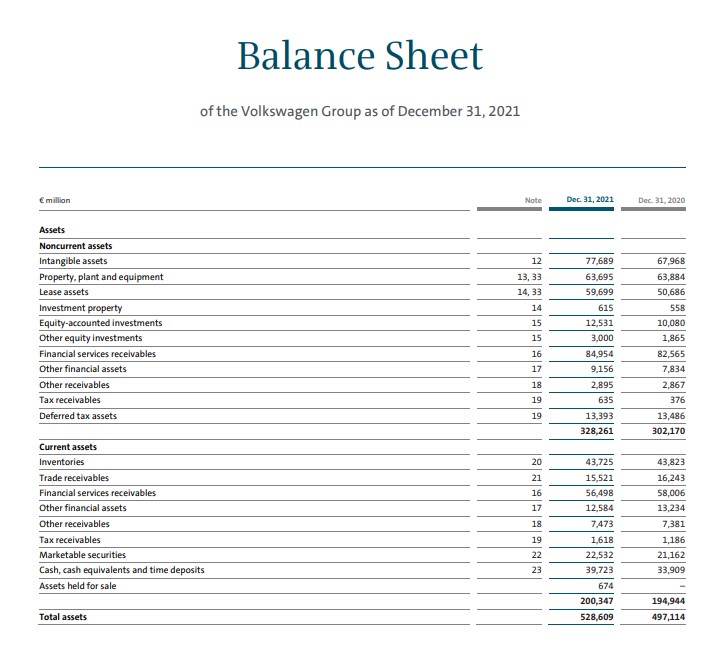

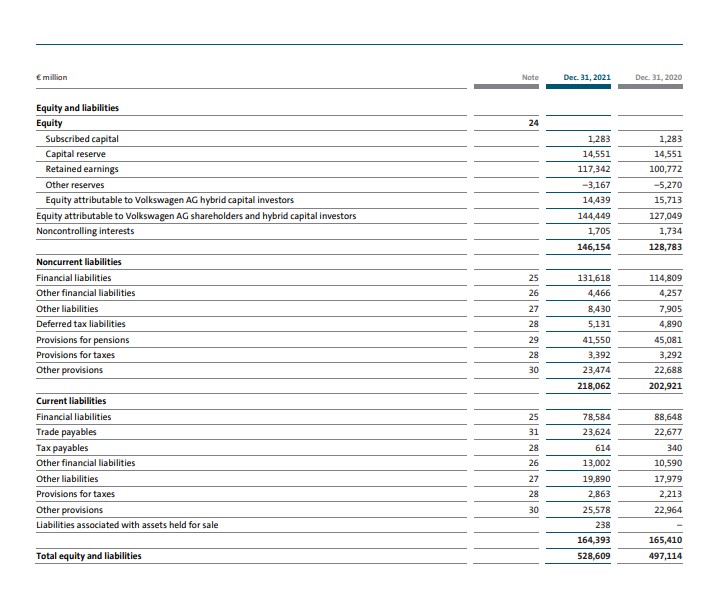

Now let’s look at the Volkswagen annual reports of the year 2021. We have taken these financial statements from Volkswagen annual reports. These include Income Statements, Balance Sheets, and Cash Flow Statements. Let’s check it out.

As per the key financial data of 2021, these are the financial statements of the Volkswagen company. In the Income statement, the Volkswagen revenues in 2021 stand at EUR 250,200 million. Whereas in 2020, Volkswagen revenues were EUR 222,884 million. The Earnings before tax in 2021 were EUR 20,126 million whereas, in 2020, it was EUR11,667 million. Whereas EAT/NOPAT of Volkswagen in 2021 was EUR15,428 million. There was a change of 75.23% as compared to 2020. The Net Income of Volkswagen stands at EUR16.32 billion in 2021.

In the Balance sheet, the total assets of Volkswagen stand at EUR 528,609 whereas the total liabilities were EUR 382,455 million. Besides that, Volkswagen capital (Equity) in 2021 stands at EUR 146,154 million.

As per the cash flow statement, in the past few years, the cash flows from investment and finance are witnessing loss. Volkswagen cash streams from operations in 2021 were EUR 38,633 million. Likewise, Cash flow from investment and financing activities stands at -26,128 million and -7,754 million. Thus, the cash flow at the end of the period was EUR 39,123 million.

The dividend history of the company is quite good for the company. In 2021, the dividend for ordinary shares is EUR 4.80($5.27)per annum and for preferred shares, it is EUR 4.86($5.34) per annum.

Volkswagen Stocks Price History

As per the Volkswagen price chart history, the stock prices are in a good rally. The company got listed in various exchanges like the London stock exchange in 2013, Frankfurt Stock Exchange, and SIX Swiss Exchange. There are basically two types of shares mainly ordinary and preferred shares. The ticker symbol of Volkswagen stock price in NYSE is VWAGY and in Frankfurt exchange, it is VOW and VOW3. In NYSE, it got listed somewhere around 1988. Then, the Volkswagen stock price(VWAGY) was $3.98 with a volume of 270k shares traded in the market. From this point, the market conditions took the Volkswagen share took the curve upwards. The Volkswagen share price on November 7, 2008, was $51.13.

However, this upward curve couldn’t withstand long. Thus, on March 6, 2009, the Volkswagen stock price was $25.51. After that, there were many ups and downs seen in the Volkswagen stock price graph. On March 20, 2020, the share price of Volkswagen was $10.68. Because of Covid 19 crisis, the prices dropped drastically.

But, the question arises, how much is the Volkswagen stock worth today? Well, as per the NYSE, the current Volkswagen stock price today (i.e March 15, 2022) is $22.91. In the past 5 years, the stock prices are recovering from the downfall with 7.76% returns.

Subsidiaries Of Volkswagen

Volkswagen has been acquiring many companies in its history. But, how many subsidiaries does Volkswagen have? Well, there are 92 subsidiaries of Volkswagen. Volkswagen mainly manufactures cars and vehicles, along with operating financial services. Abroad they acquired 3 new subsidiaries whereas they formed 9 new subsidiaries in recent years.

- Volkswagen Cars: The major brands of Volkswagen cars include Skoda, Audi, Porsche, Scania, and Man. In 2021, almost 89% of the sales revenue was from Volkswagen cars and vehicles. Recently, Volkswagen will launch “I.D Buzz” in the third quarter of 2022.

- Volkswagen Financial Services: These financial services include giving car financing solutions to people who wish to buy cars. Besides that, they also provide insurance products, direct banking services, leasing, etc. In 2021, they entered into financing and leasing of bicycles. This enables customers throughout Germany to select the bicycle of their choice at a bike shop, sign the contract there, and take the cycle with them. As per the Volkswagen annual report, almost 18% of the total revenues were from Volkswagen financial services in 2021.

- Volkswagen Power Engineering: This Power segment basically makes large-bore diesel engines, special gear machines, parts of vehicles, etc. Almost 1.3% of the total Volkswagen revenues in 2021 belong to the Power Engineering segment. Whereas in 2020, it accounted for 1.6% of the total revenues.

Risks Involved In The Company

Now that we learned about the subsidiaries of the Volkswagen company, let’s understand the risks of the company. From the analysis, the major risk of Volkswagen company is the financial risk. Financial risk refers to the risk where transactions might turn into default. Volkswagen is been facing a lot of financial risk in recent years. The chances of occurring a financial risk in Volkswagen are more than 50%. Besides that, the company has some legal risks also. The company feels that some legal lawsuits in recent years can cause high damage to the company.

Likewise, the major risk of the company is from Mergers, partnerships, and acquisitions. Although the company is into various deals, there is always a fear of the company backing out or exiting from the deal. Apart from this, there are also various other risks like market risks, industry risks, environmental risks, etc.

Is Volkswagen A Good Stock?

Now the question arises, Is Volkswagen a good stock? Is it worth investing in Volkswagen? Well, the answer is Yes. There are certain reasons for stating this fact. Firstly, although there are company stocks in different exchanges, the stock price in every exchange is doing pretty low. If you wish to hold it for a long time, then it’s the best time to buy it. Because the company has recently announced that it will launch “I.D Buzz” in the third quarter of 2022. Besides that, the deal between Volkswagen and Ford Motors is expected to increase its time tenure. Also, Volkswagen has framed a new business strategy in 2022 that will prove to be profitable for the company in the future.

However, there was some negative news also that has brought the stock down. One of them is the excess emission(release) from the diesel engines. Also, these diesel cars did not meet the emission standards of the Environment and climate change of Canada. Thus, it’s better to research and study the trends, the time before investing as this is just educational advice.

Conclusion

Volkswagen is a German company that has driven the company’s revenues and is now a part of the Fortune Global 500 list. Besides that, the company’s culture of acquiring companies and creating new subsidiaries has created a family of 92 companies. In this article, we have given a detailed analysis of the Volkswagen annual reports and Volkswagen stock prices. Likewise, we have also mentioned the different subsidiaries of Volkswagen company. We hope this article was informative to you. If you have any queries, do comment down below.

FAQs

Volkswagen couldn’t meet with U.S emissions standards from its popular turbo-diesel model “2.0 I.D”. Somebody tried to install a software in the engine to detect if the car is running an EPA emission test cycle or not. Later, it was found that the emission levels were pretty high. There were 11 million cars that were sold in the market. Likewise, other countries also faced the same problem. EPA then warned Volkswagen for this huge mistake and told them to pull back all the cars and fix this problem. Sooner, the then CEO Winterkorn resigned in September 2015.